The appeal of cryptocurrencies, particularly Bitcoin, has surged among young investors as they navigate a landscape marked by economic uncertainties. A recent survey conducted by Gemini revealed that 51% of Generation Z respondents in the United States report current or past ownership of cryptocurrency. This figure contrasts sharply with just 29% of Generation X, illustrating a significant generational shift towards digital assets.

This growing inclination towards crypto is largely driven by the challenges faced by young people today. Gen Z is grappling with the impact of artificial intelligence on job opportunities and the rising cost of living. As confidence wanes in traditional financial systems and the independence of the Federal Reserve, more young investors are viewing Bitcoin as an attractive alternative. The cryptocurrency is perceived as a portable asset that is not tied to any central bank, aligning well with the aspirations of a generation wary of conventional banking.

Changing Perspectives on Wealth and Assets

The allure of Bitcoin is further underscored by the notion that it could soon eclipse homeownership as a symbol of status among young investors. Michael Saylor, executive chairman of MicroStrategy, posits that Bitcoin embodies a new vision of the American Dream, one that prioritizes digital asset ownership over traditional property. Notably, CZ, co-founder of Binance, speculated that just 0.1 BTC, currently valued at around $10,800, might soon surpass the worth of a typical starter home in the United States.

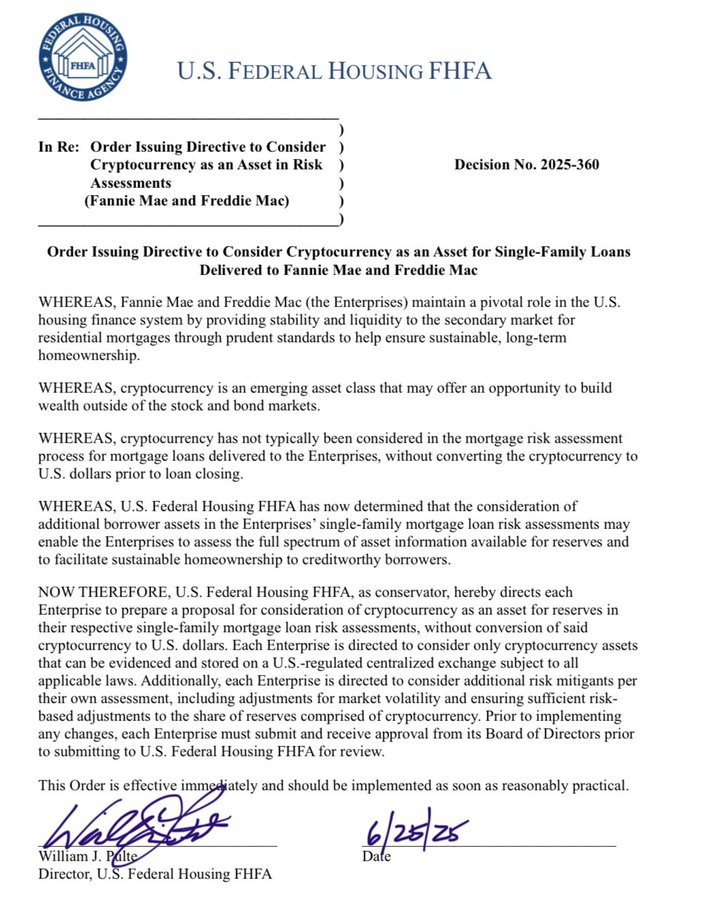

On June 25, 2025, a significant directive from FHFA Director William Pulte instructed Fannie Mae and Freddie Mac to develop plans for including cryptocurrency holdings in mortgage-reserve assessments. This initiative, which allows crypto stored on U.S.-regulated exchanges to be considered without requiring conversion to dollars, could help alleviate the tax penalties young homebuyers face when liquidating assets. According to the Gemini survey, 34% of Gen Z expressed a preference for using crypto over cash, the highest among all age groups, indicating a broader shift towards digital currencies in everyday transactions.

From Speculation to Strategic Investment

As the landscape of investment evolves, what began as speculative trading has matured into a more strategic approach among young investors. They now regard Bitcoin and Ethereum as vital components of their portfolios, serving as hedges against inflation and the uncertainties associated with job security in an AI-driven economy. One asset management executive noted, “Crypto is becoming an institutional tool,” reflecting the growing acceptance of digital assets in mainstream financial strategies.

The rise of cryptocurrencies is not just a passing trend. With regulatory clarity improving and adoption rates climbing—42.3% of U.S. Gen Z reportedly hold cryptocurrency in 2025—it is increasingly evident that digital assets are reshaping the financial landscape. As Fannie Mae and Freddie Mac continue to draft proposals that integrate crypto into traditional financial frameworks, the embrace of digital assets by Generation Z signifies a foundational shift in wealth-building strategies, potentially redefining the concept of the American Dream for years to come.

In conclusion, the growing popularity of cryptocurrencies among young investors highlights their search for alternatives amid economic instability. As they increasingly turn to digital assets, the implications for the financial system and traditional notions of wealth and ownership are profound.