Asian markets experienced a downturn on Monday as Japan’s benchmark index, the Nikkei 225, fell sharply following a significant rise in the value of the yen against the U.S. dollar. The Nikkei 225 dropped by 1.9%, closing at 52,812.45. Major exporters, including Toyota Motor Corp., faced notable declines, with Toyota shares down 3.2%. This movement reflects a broader trend where a weaker currency typically benefits Japanese exporters by boosting the value of their overseas earnings.

In the past few days, the yen appreciated significantly, with the U.S. dollar slipping to 154.26 yen from 155.01. This comes after both Japanese and U.S. officials signaled their willingness to intervene in currency markets to stabilize the yen, which had been trading around 158 yen just last week. Meanwhile, the euro strengthened against the dollar, rising to $1.1866 from $1.1858.

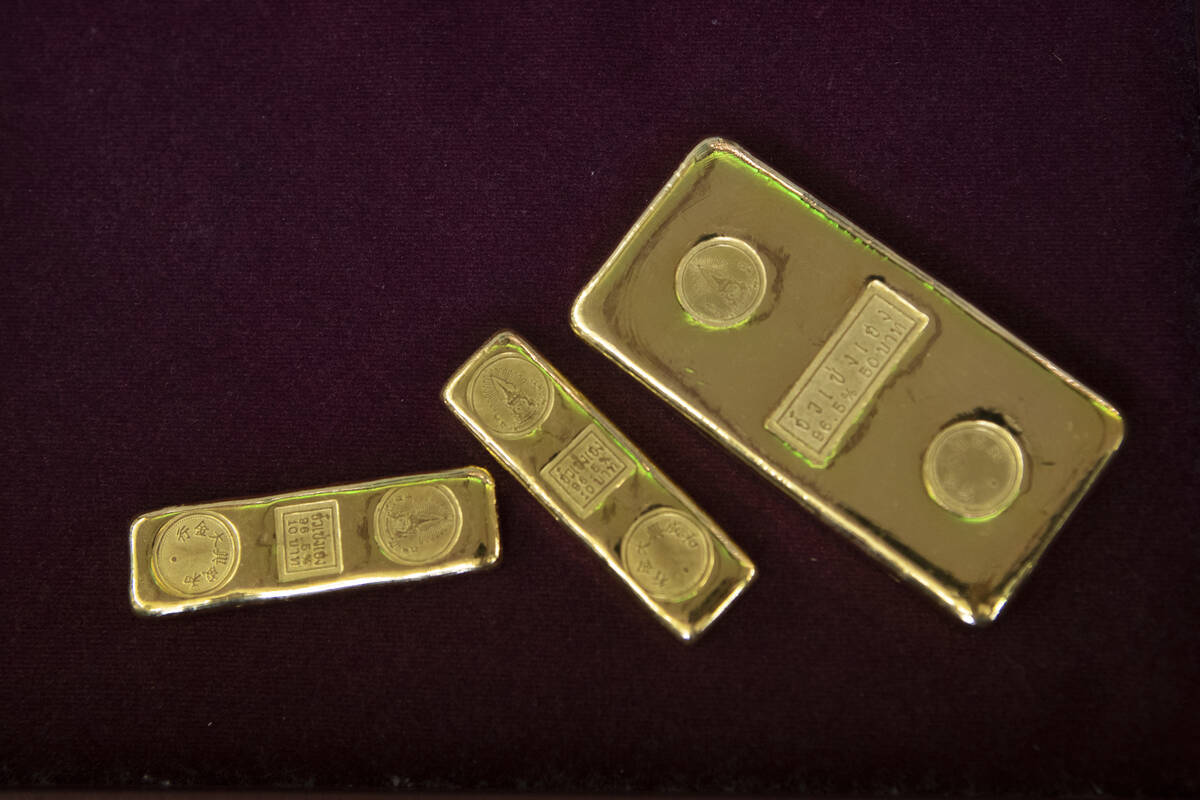

Precious Metals Surge Amid Market Uncertainty

Gold prices soared by 2% to nearly $5,100 an ounce, while silver experienced a remarkable 6.4% increase, reaching about $108 per ounce. The rise in precious metal prices reflects growing investor interest in safer assets during times of market volatility.

In South Korea, the Kospi index fell by 0.6% to 4,961.58, while Hong Kong’s Hang Seng Index dipped slightly by 0.1% to 26,722.89. Conversely, the Shanghai Composite managed a slight gain of 0.1%, closing at 4,141.10. Notably, markets were closed in Australia, New Zealand, India, and Indonesia, limiting broader regional trading activity.

As concerns linger over U.S. trade policies, futures for both the S&P 500 and the Dow Jones Industrial Average fell by 0.3%. This uncertainty was exacerbated by a recent threat from U.S. President Donald Trump to impose a 100% tariff on goods from Canada if it pursued a free trade agreement with China. Canadian Prime Minister Mark Carney promptly countered that Canada had no plans for such a deal.

In response to escalating trade tensions, Canada implemented reciprocal tariffs, including a 100% tariff on electric vehicles from China and a 25% tariff on steel and aluminum imports. China retaliated with its own tariffs on Canadian agricultural products, further straining relations.

U.S. Market Movements and Federal Reserve Outlook

On Friday, the S&P 500 closed up slightly by 0.1% to 6,915.61, but still marked a modest loss for the second consecutive week. The Dow Jones Industrial Average fell 0.6% to 49,098.71, while the Nasdaq composite gained 0.3% to 23,501.24. The decline in Wall Street stocks was influenced by a substantial 17% drop in shares of Intel, which impacted overall market sentiment.

Expectations are building as the U.S. Federal Reserve is set to meet on Wednesday. The market anticipates that it will maintain the current short-term interest rate, providing a degree of stability amid ongoing economic uncertainty.

As global markets navigate fluctuating currencies and trade dynamics, investors will be closely monitoring developments that may impact financial stability and growth prospects in the coming weeks.