Tomorrow marks a significant transition for Berkshire Hathaway as CEO Warren Buffett steps down after a remarkable 60-year tenure. At 95 years old, Buffett will pass the leadership reins to Greg Abel, who will officially take over on January 1, 2025. Buffett’s departure comes as the company holds a record cash reserve of approximately $382 billion, primarily invested in short-term U.S. Treasury bills.

Buffett’s decision to maintain such a large cash position raises eyebrows, particularly as the S&P 500 continues to soar to historic highs. The stock market has been characterized by elevated valuations, suggesting that Buffett may perceive many stocks as overpriced. This situation prompts speculation regarding whether Buffett is signaling a warning to investors about potential market risks.

Understanding Berkshire’s Cash Strategy

For the past 12 quarters, Berkshire Hathaway has been a net seller of stocks, including significant reductions in its stake in Apple, which once constituted around 50% of its portfolio but now represents just over one-fifth. Buffett’s recent selling spree has contributed to the company’s substantial cash reserves, even as it has refrained from buying back its own stock despite strong operating earnings.

Analysts propose several reasons for this cash buildup. One key factor is the appeal of risk-free returns. With short-term Treasury bills yielding between 3.6% and 4%, Buffett is opting for these safe investments over equities, particularly in a market where expected returns may not surpass inflation-adjusted risk-free rates. Other considerations may include preparing for future acquisitions or opportunistic stock buybacks if market prices decline.

Importantly, Buffett’s cash strategy might also reflect a cautious approach to capital allocation, especially as Abel prepares to assume these responsibilities.

Market Valuations and Buffett’s Caution

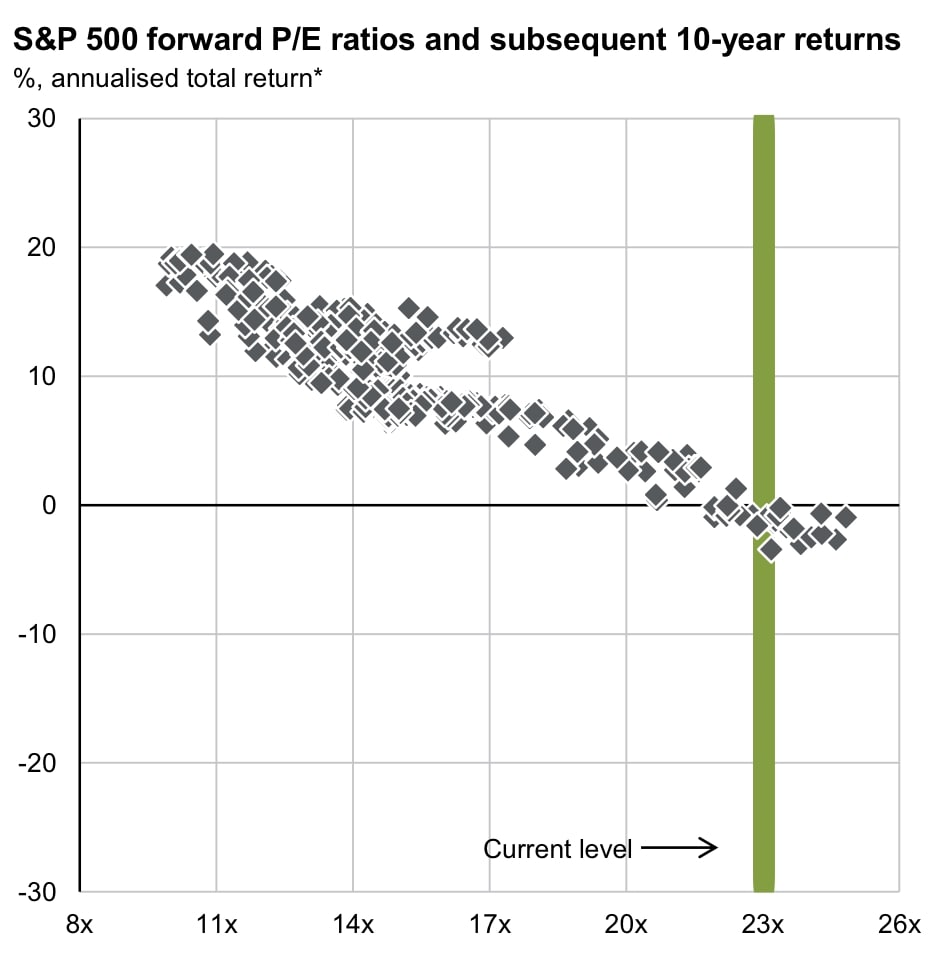

Buffett’s hesitance can be linked to insights from a valuation chart published by J.P. Morgan Asset Management. This chart illustrates that when the S&P 500’s forward price-to-earnings (P/E) ratio exceeds 23x, subsequent 10-year annualized returns have consistently been negative. Currently, the S&P 500’s trailing P/E ratio stands at approximately 31.2x, with forward estimates ranging from 22.5x to 27.9x, well above historical averages.

This situation echoes the late 1990s, when the forward P/E approached similar levels near the dot-com peak. Following that period, investors experienced a “lost decade” during the 2000s, characterized by flat to negative returns. The current market conditions could mirror that era, raising concerns about potential muted returns unless valuations adjust through earnings growth or price corrections.

Buffett has long maintained that he does not attempt to time the market, preferring to wait for attractive prices before deploying capital. The current environment, marked by high valuations and limited investment opportunities, may serve as a final cautionary note from the Oracle of Omaha.

As Buffett transitions away from daily investment decisions, his record cash position may signal to investors that caution is warranted. With stocks trading at premiums far beyond bargain levels, the message is clear: buyer beware.