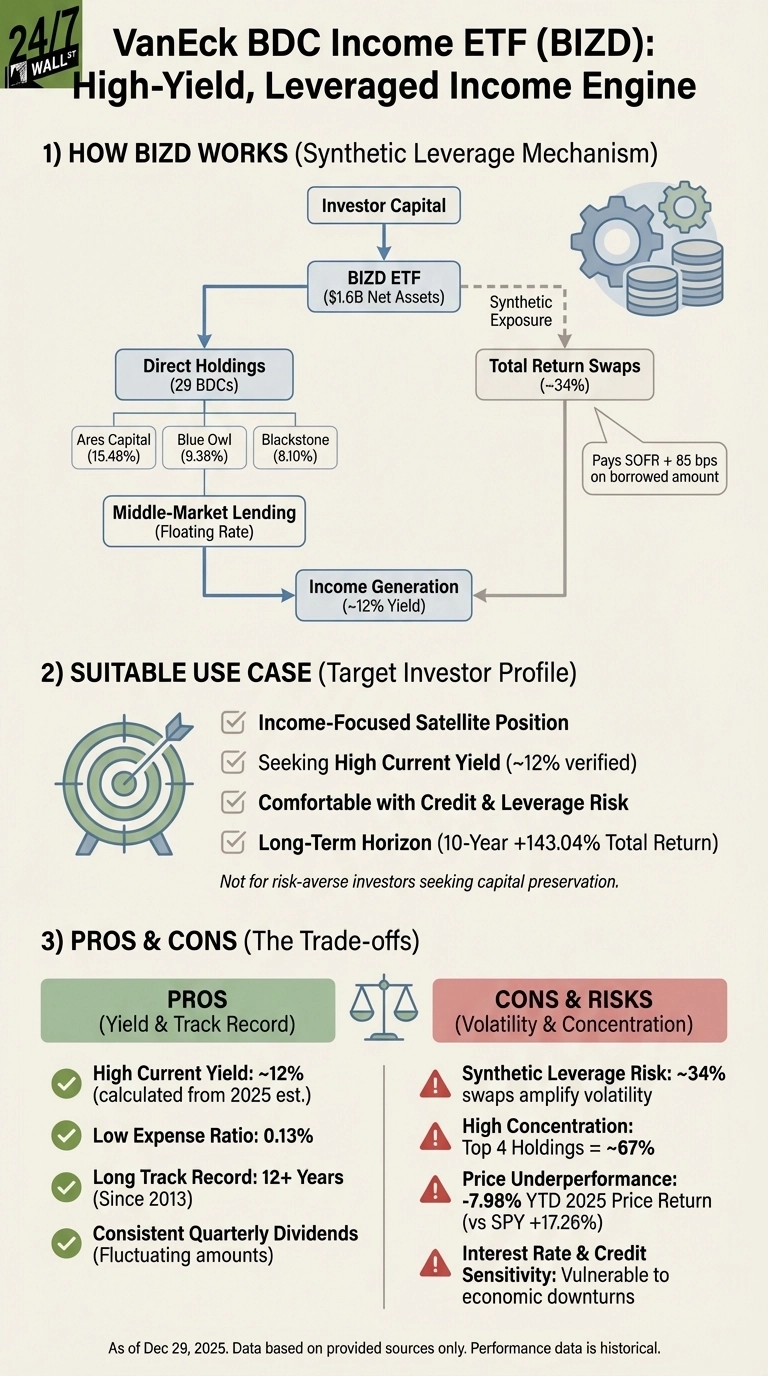

Investors looking for high income opportunities may find the VanEck BDC Income ETF (NYSEARCA:BIZD) appealing, as it currently offers a robust yield of 12%. This exchange-traded fund (ETF) employs a unique structure that combines traditional investments with synthetic leverage, allowing it to amplify both gains and losses. However, year-to-date performance reveals challenges, as BIZD has decreased by 8%, contrasting sharply with the 17% gain of the S&P 500.

BIZD’s portfolio comprises 29 individual business development companies (BDCs), along with total return swaps that constitute 34% of its assets. These swaps provide leveraged exposure to BDC indexes, allowing the fund to pay SOFR plus 85 basis points on the borrowed amounts. This structure enhances potential returns, but also introduces significant volatility.

Concentration Risks and Performance Variability

A notable characteristic of BIZD is its concentration in a small number of large BDCs. The top four holdings alone—Ares Capital, Blue Owl Capital, and Blackstone Secured Lending—account for approximately 67% of the fund’s assets. As such, the performance of BIZD is heavily influenced by these key players. A Reddit investor recently expressed concerns regarding the fund’s bond allocation, questioning whether it was implemented to mitigate volatility, given that BIZD’s performance has lagged behind other funds without bond components.

The yield of 12% is generated through dividends from the underlying BDCs, which primarily derive income from interest on middle-market loans. Many of these companies hold floating-rate debt, meaning their income can fluctuate with interest rate changes. While rising rates previously provided a benefit, uncertainty looms as the Federal Reserve contemplates potential cuts.

BIZD’s recent performance underscores these risks. Over the past decade, the fund has returned 143%, in stark contrast to the S&P 500’s 244% return. Quarterly dividends have varied between $0.40 and $0.47, reflecting the underlying BDC performance’s inconsistency. Despite a low expense ratio of 0.13%, the swap structure incurs additional costs that may not be immediately apparent to investors.

Who Should Invest in BIZD?

BIZD may appeal to those seeking high current income through alternative credit exposure. Investors comfortable with the inherent risks of middle-market lending and willing to tolerate price volatility could find the 12% yield attractive. Its track record over the past twelve years demonstrates consistent dividends, even amid market turbulence.

Nevertheless, due to its concentration and leveraged nature, BIZD is better suited as a satellite holding rather than a core income investment. The risks associated with its top holdings and the use of synthetic leverage necessitate a cautious approach, suggesting that it should represent only a modest portion of a diversified portfolio.

Three significant risks warrant careful consideration. Firstly, the leveraged nature of the fund can magnify losses as well as gains, increasing overall volatility. Secondly, the concentration in the top four holdings exposes investors to specific risks related to those BDCs. Thirdly, the dividends are tied to the performance of the portfolio companies, which can be adversely affected by economic downturns that impact middle-market borrowers.

For investors focused on capital appreciation or principal preservation, BIZD may not be the best fit, as demonstrated by its 8% decline this year.

A viable alternative is the Putnam BDC Income ETF (NYSEARCA:PBDC), which offers similar exposure without synthetic leverage. PBDC employs an actively managed strategy, holding 24 positions with less concentration than BIZD and no total return swaps. This active management approach allows for tactical adjustments in response to changing credit conditions, potentially smoothing returns during volatile periods. Though PBDC has a shorter three-year track record compared to BIZD’s twelve years, it may present a compelling option for those seeking more stability.

In summary, while BIZD delivers on its promise of a 12% yield, it requires investors to accept substantial risks related to leverage, concentration, and price volatility in exchange for that income.