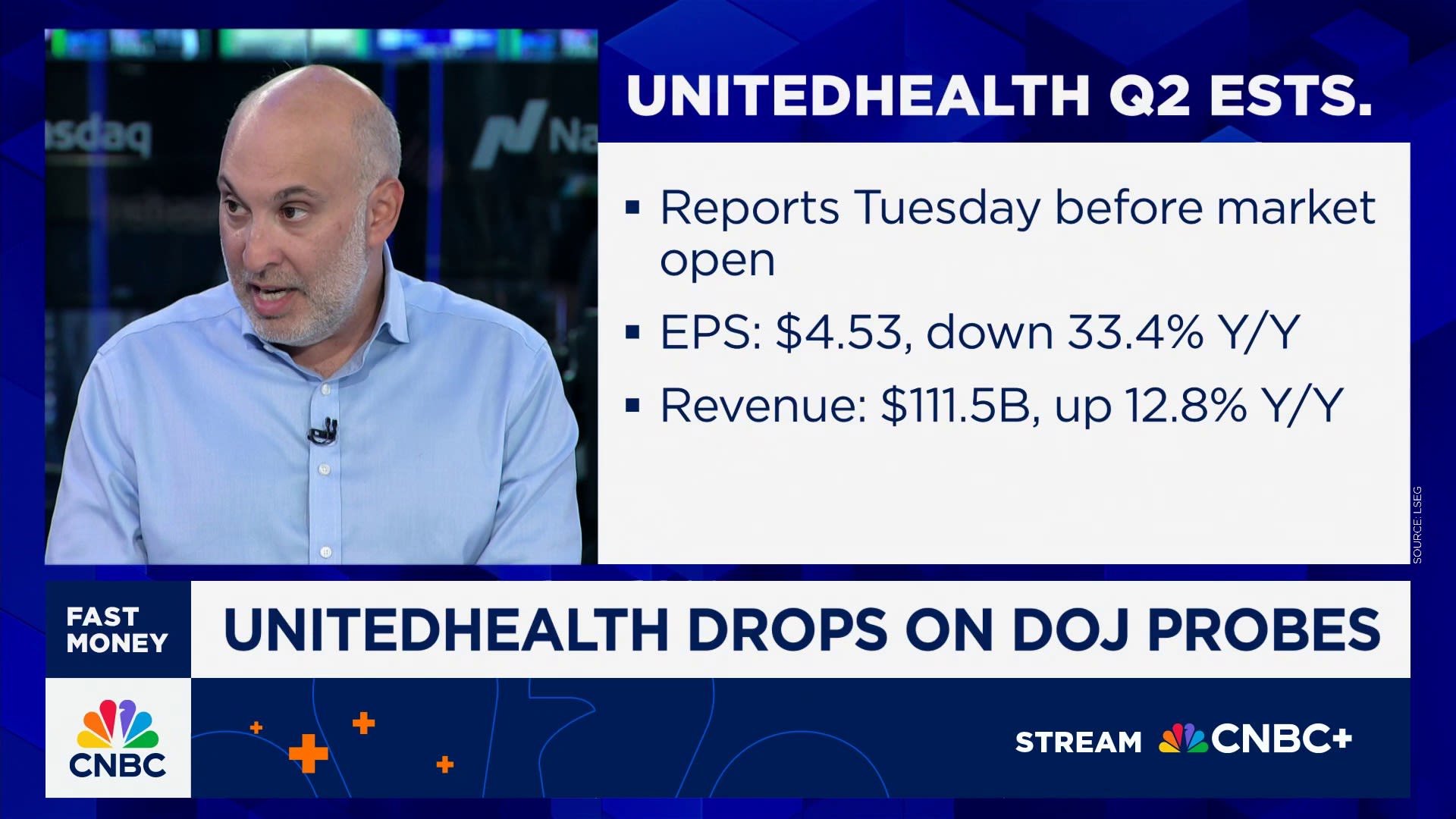

Shares of UnitedHealth Group dropped significantly following news of an investigation by the U.S. Department of Justice (DOJ). Analyst Jared Holz from Mizuho Securities addressed the implications of this development during an appearance on the financial program Fast Money on September 29, 2023. The DOJ probe raises concerns about the company’s business practices, leading to increased scrutiny from investors.

During the broadcast, Holz outlined the potential impact of the investigation on UnitedHealth’s future performance. He emphasized that the market’s reaction reflects a broader apprehension regarding regulatory challenges that could arise for the healthcare giant. The investigation could hinge on various aspects of UnitedHealth’s operations, which may affect its reputation and financial stability.

Holz noted that the stock’s decline is indicative of investor sentiment, with shares falling approximately 3.5% by the end of trading. This drop is significant, especially considering the company’s previous strong performance and resilience in the face of industry challenges. Investors are particularly wary as the DOJ’s inquiries could lead to potential legal ramifications or changes in operational practices.

The DOJ’s investigation is part of a larger trend of increased regulatory oversight in the healthcare sector. Holz highlighted that UnitedHealth, like many of its peers, faces multiple pressures, including rising costs and evolving regulatory frameworks. As the healthcare landscape continues to change, companies must navigate these complexities while maintaining profitability.

Looking ahead, Holz suggested that UnitedHealth’s management will likely need to address these concerns directly. Clear communication with stakeholders will be crucial to restore confidence and stabilize share prices. Additionally, the company may need to implement strategic adjustments to mitigate any adverse effects stemming from the investigation.

Investors are advised to closely monitor developments related to the DOJ’s probe and UnitedHealth’s responses. As the situation evolves, the implications for the company’s operations and stock performance will become clearer. In the meantime, the healthcare industry will continue to watch how regulatory scrutiny shapes the landscape for major players like UnitedHealth.

In conclusion, the recent drop in UnitedHealth’s stock serves as a reminder of the potential volatility in the healthcare sector due to regulatory investigations. Holz’s insights on Fast Money provide an important perspective on how these developments could influence the company’s trajectory in the coming months. As the DOJ’s investigation unfolds, both investors and industry analysts will be keenly observing the ramifications for UnitedHealth and the broader healthcare market.