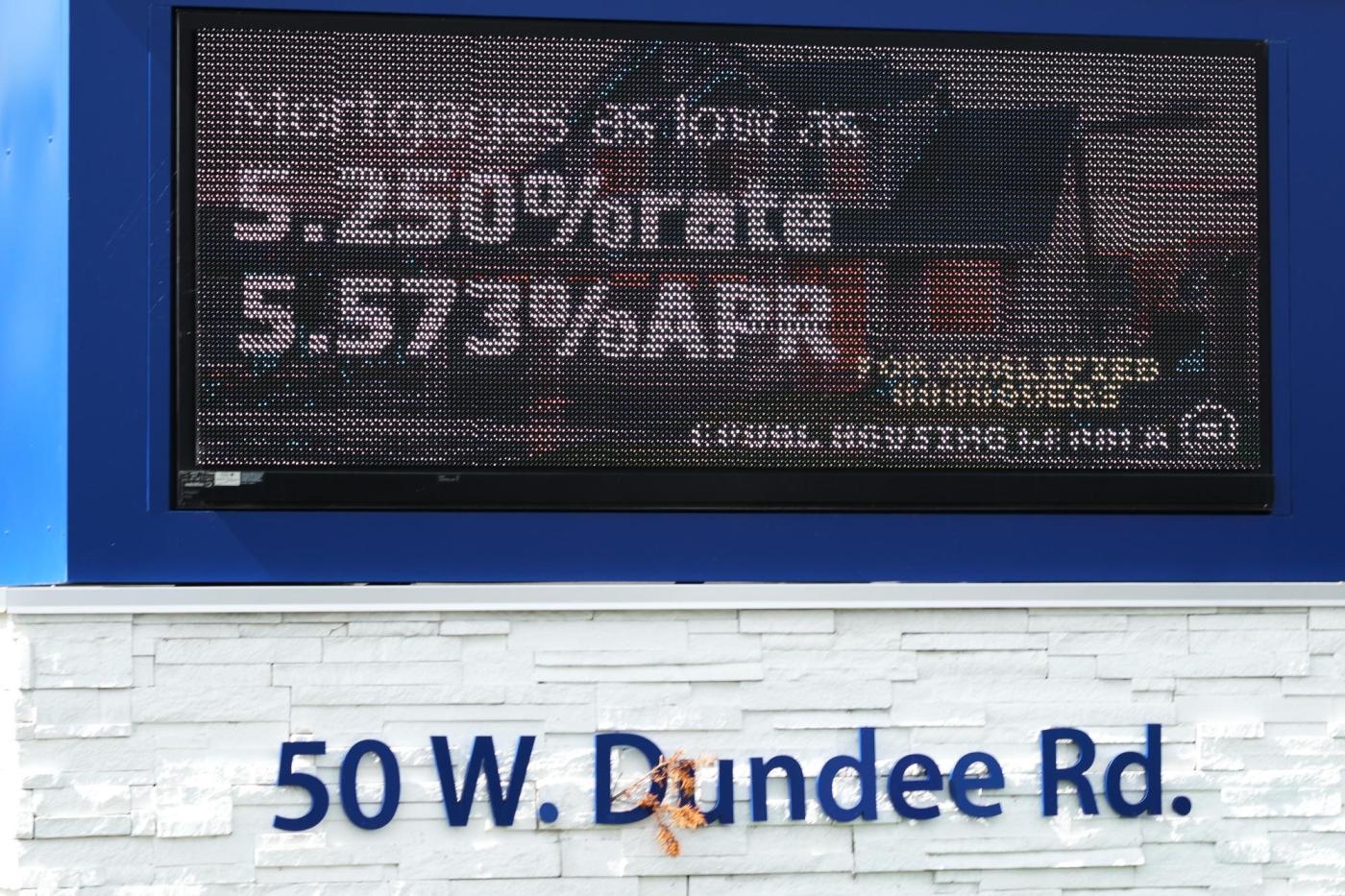

The average rate on a 30-year mortgage in the United States increased this week, concluding a four-week decline that had brought borrowing costs to their lowest point in nearly a year. According to mortgage buyer Freddie Mac, the rate climbed to 6.3% from 6.26% the previous week. A year prior, the average rate stood at 6.08%.

In addition, borrowing costs for 15-year fixed-rate mortgages, commonly sought by homeowners looking to refinance, also saw a slight increase. This rate rose to 5.49%, up from 5.41% last week, compared to 5.16% a year ago.

Several factors contribute to the fluctuation of mortgage rates, including the Federal Reserve’s interest rate policies and the expectations of bond market investors regarding the economy and inflation. Mortgage rates typically align with the trajectory of the 10-year Treasury yield, which serves as a benchmark for pricing home loans. As of midday trading on Thursday, the yield was at 4.19%, up from 4.16% the previous day.

Recent Trends in Mortgage Rates

Since late July 2023, mortgage rates have generally trended downward, influenced by the Federal Reserve’s anticipated decision last week to cut its main interest rate for the first time in a year. This move was prompted by mounting concerns regarding the U.S. job market, making financing more accessible for potential homebuyers who had been deterred by elevated borrowing costs.

The recent decline in mortgage rates had initially sparked optimism among homebuyers. However, the latest uptick may serve as a reminder of the volatile nature of the housing market. Those looking to purchase a home or refinance existing loans should remain cognizant of these fluctuations as they navigate their financial options.

While the increase in mortgage rates may dampen enthusiasm for some buyers, it remains essential to monitor broader economic indicators and trends. The interplay between interest rates, inflation, and housing market dynamics will significantly impact future borrowing costs and homebuyer sentiment.