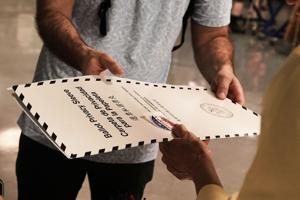

Social media platforms are abuzz with misinformation, as users falsely assert that President Donald Trump’s recently passed tax bill grants him the power to delay or cancel U.S. elections. The bill, which successfully navigated the Senate on Tuesday following a contentious overnight session, has become the center of a storm of unfounded claims.

One viral post on X, formerly known as Twitter, stated, “The reason the GOP isn’t concerned about the midterms and why they are pushing this bill is because it gives Trump power to cancel elections. If this bill passes — it’s the end of the country. Democracy is over.” Such assertions, however, are baseless and have been debunked by experts.

Understanding the Tax Bill

The tax bill in question, officially known as the Tax Cuts and Jobs Act, is primarily focused on overhauling the U.S. tax code. It aims to reduce corporate tax rates and simplify individual tax brackets. Nowhere within its extensive provisions does it address or alter electoral processes or grant any new powers to the president concerning elections.

According to constitutional experts, the authority to change election dates or cancel elections does not reside with the president. The U.S. Constitution and federal laws clearly stipulate that only Congress has the power to set the dates for federal elections.

Origins of the Misinformation

The spread of misinformation regarding the tax bill and its supposed impact on elections appears to stem from a broader climate of political distrust and the rapid dissemination of unfounded claims on social media. This phenomenon is not new; similar falsehoods have circulated in the past, often gaining traction due to the echo chamber effect of digital platforms.

Dr. Jane Simmons, a political science professor at Georgetown University, explains, “Misinformation thrives in environments where there is already a lack of trust in political institutions. Social media can amplify these narratives, making them appear more credible than they are.”

Historical Context and Expert Opinions

Historically, the idea of a sitting president unilaterally altering election dates is unprecedented and would likely face significant legal challenges. The U.S. has held elections during times of war, economic depression, and national crisis, underscoring the resilience of its democratic processes.

Legal analyst Mark Feldman notes, “The checks and balances embedded in the U.S. political system are designed to prevent any one branch from gaining too much power. The notion that a tax bill could circumvent these safeguards is not only incorrect but also reflects a misunderstanding of how American governance operates.”

“The U.S. Constitution is very clear on the separation of powers and the role of Congress in setting election dates,” says Feldman.

The Role of Social Media and Public Response

Social media companies have been under increasing pressure to combat the spread of misinformation. Platforms like X have implemented measures to flag or remove misleading content, but the sheer volume and speed at which such information spreads pose ongoing challenges.

Meanwhile, public response to the tax bill itself has been mixed, with supporters praising the potential economic benefits and critics concerned about its long-term impact on the national deficit and income inequality. However, the false claims about election control have overshadowed these substantive debates.

As the nation moves toward the midterm elections, the importance of accurate information and public awareness becomes ever more critical. Efforts by fact-checkers and media organizations to debunk false claims are vital in maintaining an informed electorate.

In conclusion, while the tax bill represents a significant shift in fiscal policy, it does not, and cannot, alter the democratic processes of the United States. Voters are encouraged to seek out reliable sources of information and remain vigilant against the spread of misinformation.