Scott Bessent, Treasury Secretary, has stated that institutional investors will not be required to sell their existing single-family home rentals, despite a recent proposal by Donald Trump. The proposal aims to restrict Wall Street firms from purchasing single-family homes to enhance affordability for American families. This measure has raised significant concerns among housing market stakeholders.

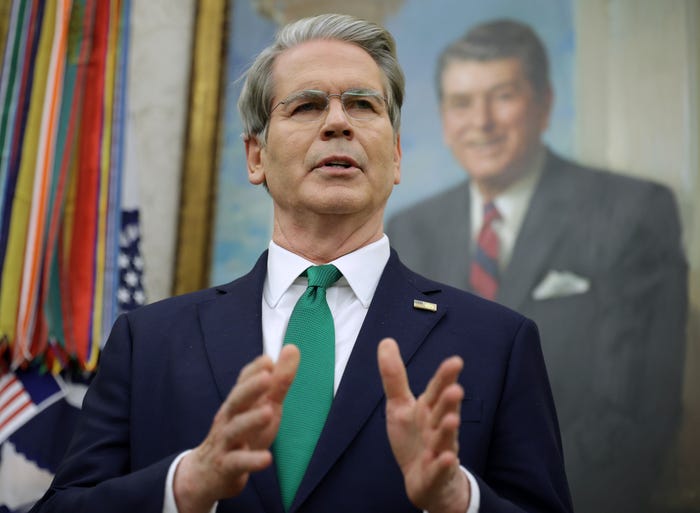

During his remarks at the Economic Club of Minnesota on March 14, 2024, Bessent clarified that while the proposal seeks to prevent further acquisitions of single-family homes by large investors, it does not impose a mandate to divest current properties. “These big institutions buy housing, then rent them out, and they’re able to depreciate it. They hide their earnings, pay lower taxes,” Bessent explained, emphasizing that past purchases would not be affected by the new regulations.

Trump’s announcement on March 13, 2024, highlighted the growing challenge for many Americans, particularly younger individuals, to achieve homeownership. He asserted that “for a very long time, buying and owning a home was considered the pinnacle of the American Dream,” but lamented that this dream is increasingly out of reach for many.

Following the announcement, shares of the asset management firm Blackstone fell by 5.6%. Blackstone, which manages approximately $1 trillion in assets, is one of the largest owners of single-family rentals in the United States, managing several hundred thousand properties. Other housing stocks also experienced declines in the wake of Trump’s statement.

Critics argue that firms like Blackstone contribute to housing market pressures by reducing the availability of homes and driving up prices. Conversely, institutional investors contend that the fundamental issue is a lack of housing supply rather than their ownership of properties.

Bessent noted that the administration has yet to finalize the specifics of the proposed ban, stating, “We want to keep the traditional mom and pop owners in. We want to keep families who rent out to their other family members.” He also referenced the trend of large firms buying single-family homes, which began during the 2008 financial crisis. At that time, private equity firms were among the few entities with sufficient capital to acquire these properties, leading to what he described as a “hoovering up” of the single-family housing stock.

According to the U.S. Government Accountability Office, the five largest institutional investors owned nearly 2% of single-family rental homes as of 2022, indicating a significant presence in the housing market. As discussions continue regarding the implications of Trump’s proposal, the balance between institutional investment and individual homeownership remains a critical topic for policymakers and stakeholders alike.