A recent 42-minute video from a conservative content creator has sparked significant actions from officials in the Trump administration, who claim rampant fraud within federal safety net programs. Although investigations have yet to substantiate the video’s allegations regarding child care centers in Minnesota, the administration has responded by freezing all federal child care payments to the state. Additionally, it rescinded a rule established during the Biden administration that was intended to mitigate fraud risks.

This initiative includes a comprehensive audit of Minnesota’s Medicaid billing and the suspension of funds for various programs in five states led by Democratic officials while the government investigates potential fraud. Vice President JD Vance announced that the administration will soon appoint an assistant attorney general focused on investigating and prosecuting fraud. Furthermore, the Treasury Department is enhancing its oversight of financial institutions in Minnesota, aiming to ensure compliance with regulations designed to detect financial misconduct.

Fraud, waste, and abuse in federal programs have been longstanding concerns for Republican administrations, but the current administration has amplified these claims. Allegations have emerged regarding fraud in the distribution of benefits across programs like food stamps, Social Security, Medicaid, and the Affordable Care Act. Critics argue that the administration’s claims often lack accuracy and are exaggerated.

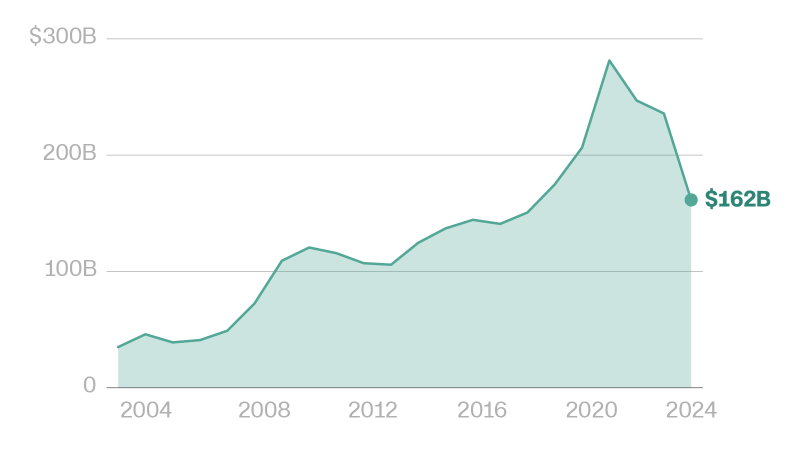

The Government Accountability Office (GAO) estimated in March 2024 that between $233 billion and $521 billion in federal funds could be lost annually to fraud, representing approximately 3% to 7% of average federal obligations. The report noted that while many improper payments occur, not all are fraudulent; some stem from administrative errors. For instance, the federal government reported around $162 billion in improper payments across 68 programs in the 2024 fiscal year.

The COVID-19 pandemic saw a surge in fraud as criminals exploited weakened oversight during the rollout of emergency relief programs. “The lesson from the pandemic is how enterprising and opportunistic and coordinated and sophisticated the fraud actors were,” remarked Linda Miller, founder of the nonprofit Program Integrity Alliance. Despite long-standing GAO warnings about vulnerabilities in federal programs, many of these issues remain unaddressed due to a lack of decisive action.

The Trump administration has sought to enhance data sharing between federal and state agencies to combat fraud. This has raised concerns regarding privacy and targeting vulnerable populations, particularly immigrants. Some agencies, along with Republican lawmakers, have also pushed for stricter verification requirements for federal benefits.

A more effective use of technology is suggested to combat fraud, with data matching and artificial intelligence being highlighted as potential tools. Matt Weidinger, a senior fellow at the American Enterprise Institute, emphasized the importance of ensuring that funds are allocated correctly, arguing that concerns over data sharing are overstated given the existing threats from criminal activities.

Fraud in federal programs often involves organized crime groups rather than individual applicants attempting to manipulate eligibility requirements, according to Miller. “There’s so little understanding of the participation of these organized crime groups and how good they are,” she noted, suggesting that the focus on individual fraud detracts from the larger issues at play.

In a recent cabinet meeting, Agriculture Secretary Brooke Rollins cited alarming statistics regarding fraud in the Supplemental Nutrition Assistance Program (SNAP). She reported that 186,000 deceased individuals’ Social Security numbers were used to collect benefits and that approximately half a million people received benefits in multiple states. The USDA has indicated that states lose an estimated average of $24 million daily due to undetected fraud and errors, translating to potential annual savings of $9 billion if these issues are resolved.

In terms of Medicaid, the Centers for Medicare and Medicaid Services (CMS) have identified that 2.8 million individuals had overlapping coverage in multiple states or were enrolled in both Medicaid and subsidized Affordable Care Act plans. The agency aims to reduce duplicate enrollments and has reported significant improper payments made on behalf of deceased beneficiaries.

The GAO has also documented instances where fictitious applicants received substantial coverage and subsidies. In a recent report, nearly 200,000 applications were flagged for unauthorized changes, highlighting ongoing issues with fraud among agents and brokers.

In the realm of Social Security, the department has initiated various anti-fraud measures since the beginning of the Trump administration. This includes requiring some applicants to verify their identities in person, as well as holding retirement benefit applications for additional scrutiny. Although some measures faced pushback and were eventually rescinded, the administration continues to emphasize the need for enhanced oversight.

The child care sector is another focus of scrutiny. A report from the Office of Child Care indicated that an estimated 3.6% of payments from the Child Care and Development Fund grant program were improper in 2023. Following allegations of fraud in Minnesota, the administration has frozen child care payments and rescinded a rule that it claimed weakened oversight.

Robert F. Kennedy Jr., the Secretary of Health and Human Services, stated, “Loopholes and fraud diverted that money to bad actors instead.” Critics argue that the administration’s actions may be more about shifting policy priorities than addressing fraud effectively. Ruth Friedman, a former director at the Office of Child Care, noted that the decision to rescind the Biden-era rule was made long before the recent allegations surfaced, suggesting that the administration’s motivations may not align with a genuine effort to combat fraud.

The ongoing discourse surrounding fraud in federal programs highlights a complex interplay of policy, oversight, and accountability. As investigations continue and new measures are proposed, the administration’s approach to addressing these issues will likely remain a focal point of political debate.