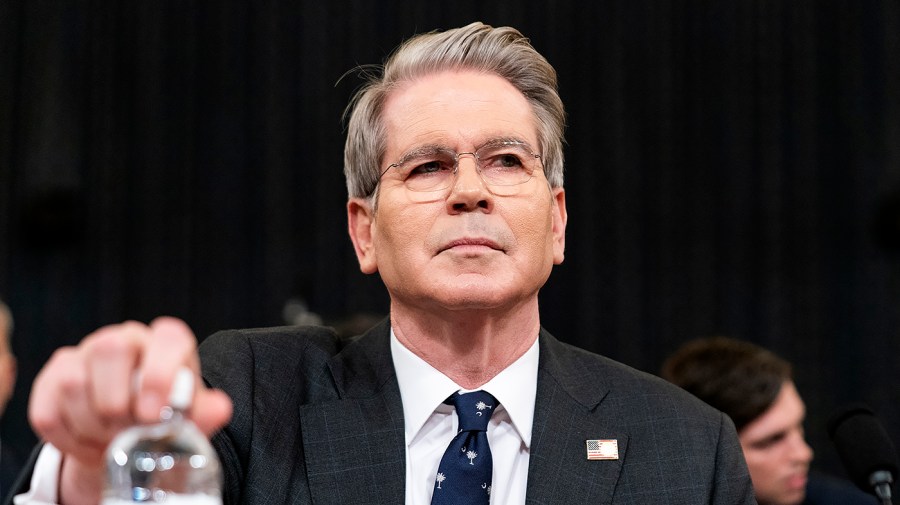

JUST IN: Treasury Secretary Scott Bessent has launched a fierce critique against leakers following a Wall Street Journal report that claims he attempted to dissuade President Donald Trump from firing Federal Reserve Chair Jerome Powell. This explosive revelation comes as tensions rise within the administration, sparking widespread speculation about the future of monetary policy.

In a live interview on CNBC earlier today, Bessent was asked about the authenticity of the Journal’s claims. He did not hold back, condemning the “leakers” who he believes jeopardize the integrity of government discussions. The report, released on October 29, 2023, details a dramatic internal debate, highlighting the strain between economic policy and political strategy.

The implications of this clash are significant. With the economy facing challenges, the stability of the Federal Reserve is crucial. Any attempt by the President to remove Powell could lead to market instability and further uncertainty among investors. Bessent’s remarks underline the seriousness of the situation, emphasizing that “leaking information in this context is irresponsible and harmful.”

President Trump has publicly dismissed the Journal’s report, stating on social media that it is “fake news.” However, the fallout from this controversy raises questions about the administration’s cohesion and its approach to economic governance.

As the situation develops, all eyes are on the White House and the Federal Reserve. Will the administration’s internal disputes impact economic policy? Stakeholders are eagerly awaiting further announcements from both Bessent and Trump as the potential fallout from this incident continues to unfold.

WHAT’S NEXT: Keep an eye on upcoming press conferences and statements from the Treasury Department and the White House as this story develops. The tension surrounding the Federal Reserve’s leadership could have lasting implications on the U.S. economy and financial markets. This is a critical moment that could shape future economic policy.