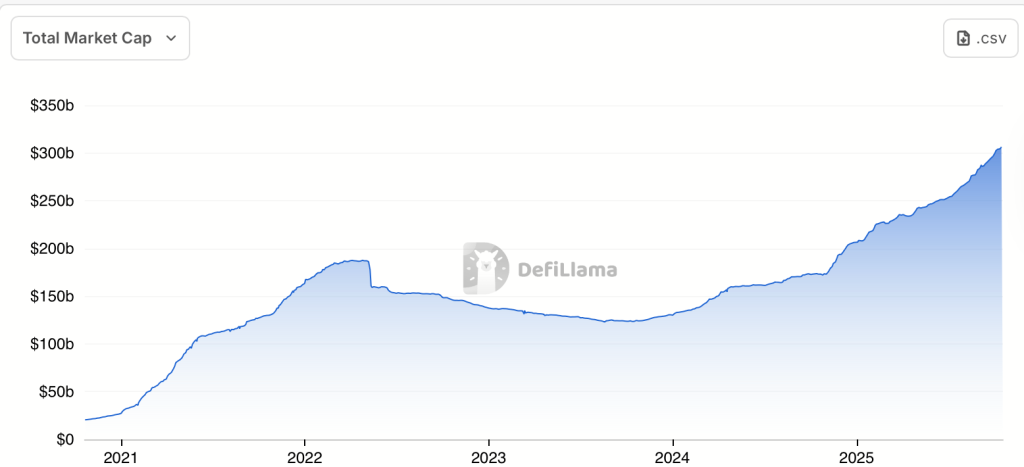

The total supply of stablecoins has surged to a record $304.5 billion, indicating a significant accumulation of liquidity in the cryptocurrency market. This substantial pool of capital is poised to drive investment into Bitcoin (BTC), Decentralized Finance (DeFi), and various altcoins, potentially signalling the onset of the next major bull run.

The recent performance of Bitcoin, with prices hovering around $107,000, along with the recovery of leading altcoins such as Ethereum (ETH), Solana (SOL), and Avalanche (AVAX), reflects a shift in market sentiment. Increased institutional interest and heightened on-chain activity are contributing to a more optimistic outlook among investors.

Stablecoin Market Trends

The rise in stablecoin supply to an all-time high suggests a substantial buildup of liquidity, demonstrating heightened investor confidence. Stablecoins, which are primarily pegged to the U.S. dollar, have become a foundational element of the crypto economy, offering stability and facilitating seamless transactions. Historical trends indicate that significant increases in stablecoin reserves often precede major rallies in Bitcoin and other digital assets.

Analysts note that the accumulation of such large reserves typically creates bullish momentum across the cryptocurrency sector when reinvested into riskier assets or yield-generating protocols. As stablecoins serve as a bridge to the broader crypto market, their increased circulation suggests that investors are positioning themselves for upcoming opportunities.

Potential Catalysts for Growth

The influx of capital into Decentralized Finance (DeFi) and the tokenization of real-world assets (RWAs) stands out as key areas for potential growth. DeFi platforms, including lending services, decentralized exchanges, and yield farming opportunities, are drawing stablecoin investments, driven by the pursuit of attractive yields. Enhanced security measures and the introduction of institutional-grade protocols are further reinforcing DeFi’s role as a vital component of the financial ecosystem.

Additionally, the tokenization of assets such as bonds, treasuries, and real estate is gaining traction. Financial institutions like BlackRock and Standard Chartered are exploring blockchain-based settlements utilizing stablecoins, demonstrating a shift towards innovative financial solutions.

Several factors could catalyze the deployment of this substantial liquidity pool. Regulatory clarity, increased institutional adoption, and macroeconomic developments could drive capital onto blockchain platforms. A decisive policy shift or the integration of stablecoin payments by major financial organizations could act as a trigger for the next liquidity cycle in the cryptocurrency market.

The record stablecoin supply of $304.5 billion is more than just idle cash; it represents a significant opportunity for the future expansion of the cryptocurrency landscape. As interest in DeFi and RWAs continues to accelerate, this liquidity may soon re-enter the market, potentially propelling Bitcoin, Ethereum, and DeFi tokens to new heights in the near future.