URGENT UPDATE: The New Zealand Dollar has dropped sharply below the 0.6000 support level against the US Dollar, signaling potential further declines. This fresh decline is raising concerns among traders as technical indicators suggest an ongoing bearish trend.

As of now, NZD/USD is trading at 0.5985, having started its downward trajectory from 0.6120. The pair has breached critical support levels at 0.6050 and 0.6020, marking a significant shift in market sentiment.

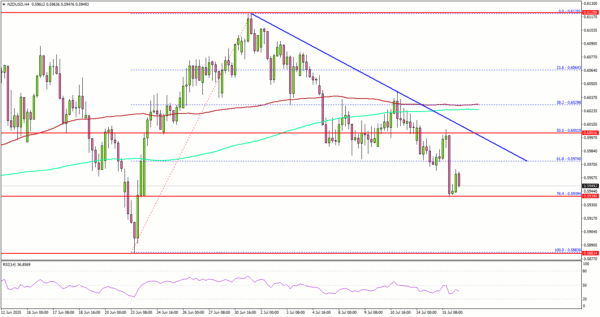

On the 4-hour chart, a key bearish trend line has formed, with resistance firmly positioned at 0.6000. This development comes as the pair trades below both the 100 and 200 simple moving averages, indicating a strong downward momentum. Immediate support is now found near 0.5940, closely aligned with the 76.4% Fibonacci retracement level of the recent upward movement.

Analysts warn that if the pair continues to decline, it could approach the next support level at 0.5900. Further losses could push it down to the 0.5880 zone, raising alarms for investors and traders alike.

Meanwhile, the EUR/USD pair is also experiencing losses, recently falling below the 1.1650 support level, indicating broader market weakness. This trend reflects growing uncertainty in the currency markets, exacerbated by upcoming economic data.

Looking ahead, traders should brace for the upcoming US Producer Price Index reports scheduled for release in June 2025. The month-over-month forecast stands at +0.2%, while the year-over-year forecast is projected at +2.5%, slightly down from +2.6% previously. These figures could influence market dynamics as investors react to inflation data.

The situation remains fluid, and market participants are advised to stay alert for any further developments. A close above the 0.6030 level could potentially signal a rebound, but until then, the bearish outlook for NZD/USD is dominating sentiment.

In this volatile environment, the implications for traders and investors are significant, and many are reassessing their strategies in light of the rapid changes in currency valuations.

Stay tuned for more updates as the situation evolves.