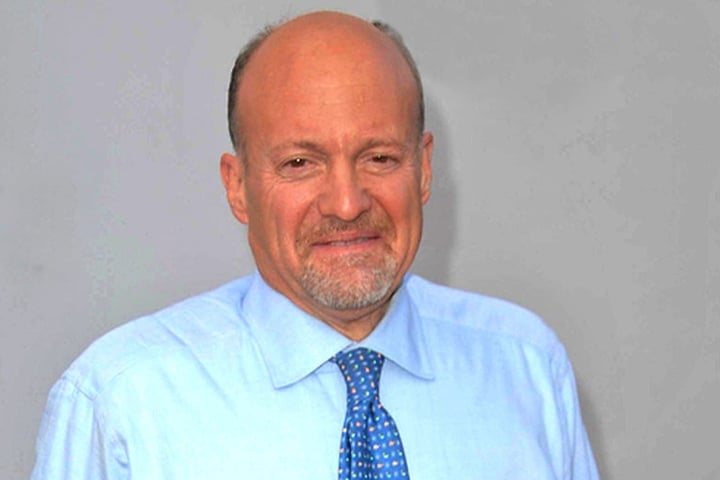

TV personality Jim Cramer has expressed renewed confidence in the banking sector, emphasizing that many bank stocks are currently undervalued. In a recent post on X, the host of CNBC’s “Mad Money” highlighted that, among these stocks, Capital One Financial Corp. (NYSE: COF) stands out as the “cheapest of all,” suggesting it has the “most upside” potential.

Cramer, a long-time supporter of Capital One, noted his bullish stance on the stock, referencing a price increase of “60 points.” This endorsement follows Capital One’s significant acquisition of Discover Financial Services, a deal valued at $35.4 billion that closed earlier this year. Analysts anticipate this merger will create substantial synergies for the bank.

Market Performance and Analyst Ratings

Capital One currently holds $56.92 billion in excess capital, positioning it well for future buybacks. The stock trades at a price-to-earnings ratio of just 10.91 times forward earnings, making it an attractive option for investors. Year-to-date, Capital One’s stock has gained 29.15%, showcasing a strong performance relative to its peers.

Analysts from various firms have recently adopted a more optimistic outlook on Capital One. Wolfe Research initiated coverage with an “Overweight” rating, setting a target price of $270 per share, indicating a potential upside of 16.97%. Similarly, analysts at Citigroup have reaffirmed their “Buy” rating and raised their target from $275 to $290, which translates to a 25.64% upside from current levels.

The broader banking sector has seen substantial growth this year, bolstered by the results of the 2025 Federal Reserve stress test. Major banks, including Capital One, passed the test successfully, allowing for approximately $100 billion to be returned to shareholders through dividends and buybacks.

Shares of Capital One rose by 0.09% on Tuesday, closing at $230.81, and saw an overnight increase of 0.52%. The stock has also received high momentum scores in various rankings, reflecting its positive price trend over short, medium, and long-term periods.

Investors and analysts alike are closely monitoring Capital One’s performance as the banking sector continues to evolve, particularly in light of recent strategic moves and market conditions. As Cramer and other analysts highlight the potential for significant upside, Capital One remains a stock to watch in the coming months.