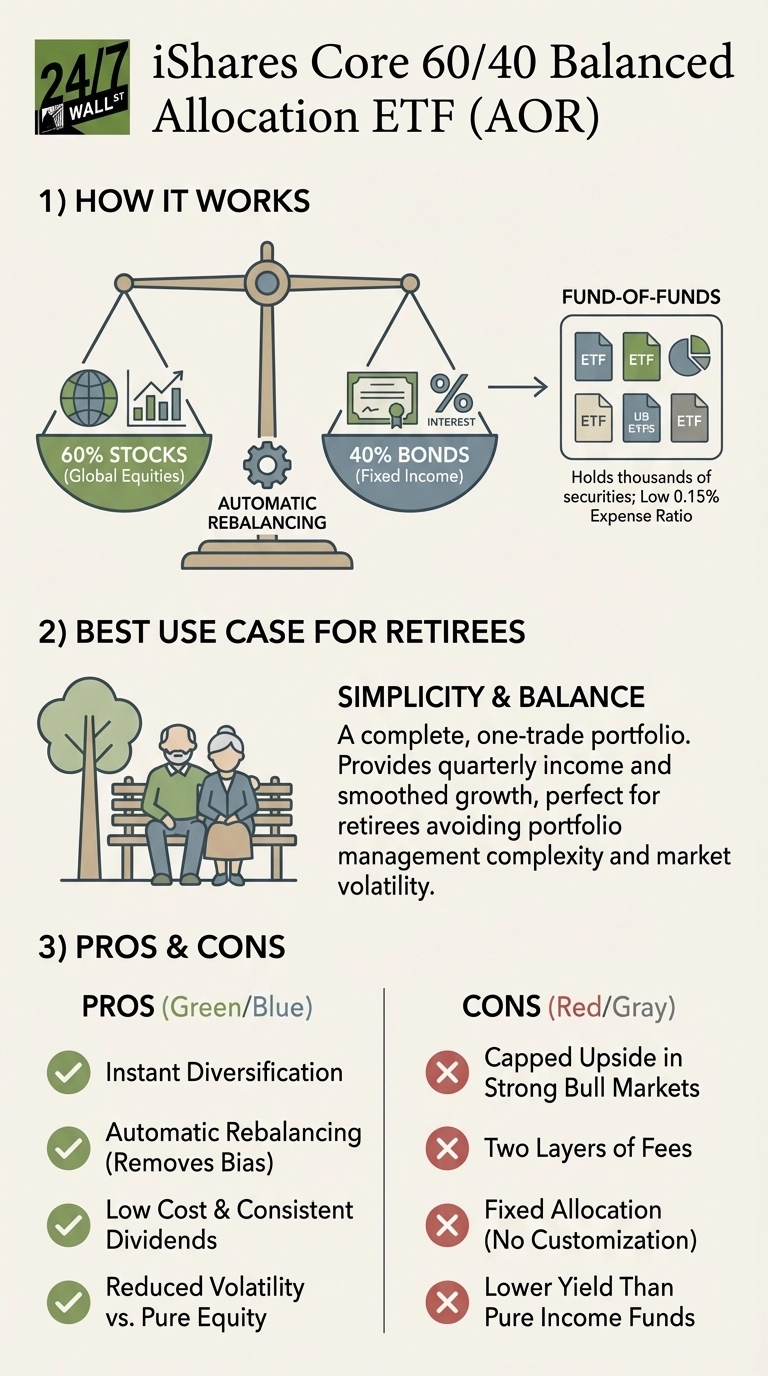

The iShares Core 60/40 Balanced Allocation ETF, known as AOR, offers a comprehensive investment solution for retirees by combining a balanced portfolio of 60% stocks and 40% bonds into a single fund. With an expense ratio of just 0.15%, AOR has returned approximately 14% in 2025 and has averaged around 8% annually over the past decade. This structure aims to alleviate the complexities of managing multiple investment funds, allowing retirees to focus on generating stable returns amid market fluctuations.

Understanding AOR’s Structure and Benefits

AOR operates as a fund-of-funds, holding various iShares ETFs to maintain its targeted asset allocation. This approach provides instant diversification across thousands of securities, including U.S. stocks, international equities, and investment-grade bonds. The automatic rebalancing feature of AOR means it adjusts its holdings to maintain the 60/40 split, helping investors avoid the behavioral pitfalls associated with market volatility, such as selling winning assets and holding onto losers.

The fund has consistently distributed dividends since its inception in 2008, currently yielding approximately 2.5%. For retirees who desire a straightforward income stream without the hassle of managing multiple positions, AOR offers a level of simplicity that can be particularly appealing.

One noteworthy aspect of AOR’s performance is its resilience during market downturns. In 2022, when both stocks and bonds faced declines, AOR’s diversified strategy limited losses compared to portfolios heavily weighted in equities alone. The fund’s ability to capture equity upside, while mitigating volatility through its bond allocation, demonstrates the potential for a balanced investment approach to support a stable retirement journey.

Evaluating Performance and Alternatives

Despite its advantages, AOR’s balanced approach does come with trade-offs. The 40% bond allocation can restrict upside potential during bull markets. Investors who focused solely on equity funds experienced greater gains during the market rallies of 2023 and 2024. Furthermore, AOR’s fund-of-funds structure means investors incur two layers of fees: AOR’s 0.15% expense ratio, in addition to the costs associated with the underlying ETFs.

For retirees who prioritize income, AOR may not suffice, particularly for those seeking higher current distributions. An alternative is the iShares Core Conservative Allocation ETF, known as AOK, which features a more conservative 30% equity and 70% bond allocation. AOK currently offers a yield of 3.3%, appealing to those who require more immediate income, albeit at the cost of potential long-term returns lagging behind AOR’s by approximately 2-3% annually.

Investors with a longer time horizon, particularly those more than 20 years from retirement, may find AOR’s bond allocation unnecessarily limiting. The fixed 60/40 strategy may not align with their growth objectives.

As retirement approaches, the choice between AOR and AOK can hinge on individual risk tolerance and income needs. While AOR presents a balanced option for newly retired individuals seeking simplicity, its fixed allocation implies an acceptance of capped upside potential alongside moderate income generation.

In light of the evolving financial landscape, retirees are encouraged to evaluate their investment strategies to ensure a reliable income stream. The transition from wealth accumulation to income generation poses challenges that many overlook, particularly for those in their 50s, 60s, and 70s.

For those seeking guidance, resources like The Definitive Guide to Retirement Income provide strategies to effectively convert investments into a sustainable income source. Understanding the intricacies of managing retirement income can significantly enhance financial security during retirement years.