UPDATE: Investors are buzzing with anticipation as the annual Santa Claus rally is projected to kick off this December, driven by heightened consumer spending and year-end bonuses. Analysts report a surge in optimism that could significantly impact the stock market in the coming weeks.

The Santa Claus rally refers to the phenomenon where stock prices rise during the last week of December and the first two trading days of January. This year, experts are predicting a robust rally fueled by strong holiday shopping trends. Retailers have reported a 10% increase in sales compared to last year, with many attributing this surge to consumers spending their bonuses and holiday savings.

According to a recent report from MarketWatch, this year’s holiday season is expected to be one of the busiest on record, with consumers projected to spend $1 trillion in retail sales nationwide. This revitalization in consumer confidence is critical, providing a strong foundation for the stock market to rally as investors look for positive signs heading into 2024.

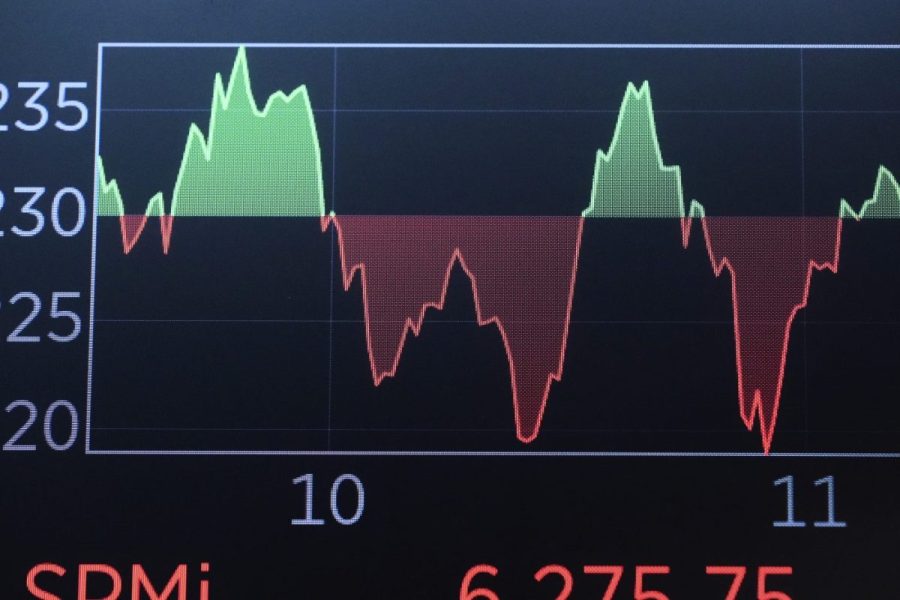

The financial markets are closely watching key indicators, including consumer sentiment and early retail sales data. Goldman Sachs recently reported that a successful holiday shopping season could lead to a potential gain of 5% to 7% for the S&P 500 index during the Santa Claus rally period.

As we approach the holidays, many investors are also encouraged by the anticipated release of year-end bonuses, which could further drive spending and bolster market performance. This year, bonuses are expected to average $20,000 per employee in the finance sector, contributing to overall economic growth.

The implications of a successful Santa Claus rally extend beyond Wall Street. A strong performance in the stock market can significantly boost retirement accounts, impacting millions of Americans. As the financial landscape continues to evolve, the effects of this rally will be felt across various sectors, from retail to technology.

What happens next? As consumer purchasing power grows, analysts are urging investors to keep a close eye on retail earnings reports slated for release in mid-December. These reports will provide critical insights into how businesses are performing and whether they are meeting consumer demand.

With the holiday season just around the corner, the excitement in the markets is palpable. Investors are advised to stay informed and ready to act as the Santa Claus rally unfolds. The next few weeks could be pivotal in shaping the economic outlook for 2024.

Stay tuned for updates as we monitor the developments of this festive season and the potential impact on the stock market.