The phenomenon known as a Santa Claus rally is drawing significant attention from investors as the holiday season approaches. This rally typically occurs during the last week of December and the first two trading days of January, characterized by a notable increase in stock prices. The optimism surrounding this period is largely driven by heightened consumer spending and the influx of year-end bonuses.

During this time, many investors anticipate a boost in market performance, fueled by the surge in holiday shopping. According to the National Retail Federation, U.S. holiday sales are projected to increase by 6-8% compared to the previous year, potentially reaching $1.1 trillion. Such spending trends create a favorable environment for businesses and, subsequently, for stock prices.

Understanding the Factors Behind the Rally

The underlying causes of a Santa Claus rally can be traced to several key factors. Investor sentiment tends to be more optimistic during the festive season, as many are buoyed by the spirit of giving and celebration. Additionally, bonuses received by employees often lead to increased investments in the stock market. This influx of capital can contribute to rising stock prices, reinforcing positive market sentiment.

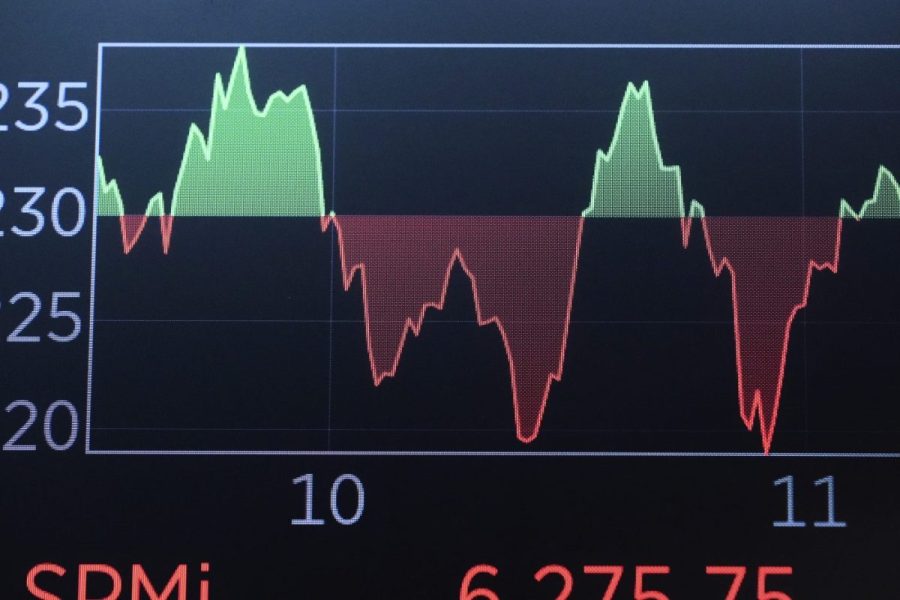

Furthermore, the retail sector plays a crucial role in this period. Retailers often experience a significant uptick in sales, which can lead to better-than-expected earnings reports. Positive earnings announcements frequently encourage further investment, creating a cycle that bolsters the market. For instance, last year’s Santa Claus rally saw the S&P 500 index rise by approximately 1.5% over the same period.

Market analysts suggest that the sentiment surrounding a Santa Claus rally is not merely anecdotal. Historical data shows that this rally has occurred in many years, with the average return during this timeframe generally proving positive. According to a study by Yardeni Research, the S&P 500 has risen about 77% of the time during the Santa Claus rally period since 1969.

The Broader Economic Context

While the Santa Claus rally is a noteworthy event in the financial calendar, it is essential to consider the broader economic context. Factors such as inflation, interest rates, and geopolitical events can also significantly impact market performance. As of December 2023, inflation rates are stabilizing, and central banks are beginning to signal potential shifts in monetary policy, which could influence investor behavior.

Moreover, analysts are keeping a close eye on consumer confidence indices, which provide insights into how willing consumers are to spend. As these indices rise, the likelihood of a robust Santa Claus rally increases, creating a positive feedback loop for the stock market.

In conclusion, the Santa Claus rally represents a unique intersection of holiday cheer and market dynamics. As investors look to capitalize on this seasonal trend, the interplay between consumer spending, investor sentiment, and broader economic conditions will be pivotal. With projections for strong retail performance this year, many are hopeful that the rally will deliver significant returns, making the last trading days of December an exciting time for market participants.