Investors in India are reevaluating their strategies as high net worth individuals (HNWIs) adapt to changing market conditions. Recent data indicates a significant shift in investment preferences, with a growing emphasis on diverse asset classes rather than traditional avenues. This movement reflects broader economic trends and individual risk appetites.

According to the Global Wealth Report 2023 published by Credit Suisse, India’s HNWIs—defined as individuals with a net worth exceeding $1 million—number approximately 376,000. As these investors navigate the complexities of the current economic landscape, they are increasingly turning to alternatives such as real estate and venture capital, while also maintaining a presence in equity markets.

Shifting Preferences Towards Real Estate and Gold

Data from the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) shows that while equities remain a popular choice, many HNWIs are diverting funds into real estate, which offers tangible assets and potential long-term appreciation. Reports indicate that in June 2023, investments in real estate surged by over 20% compared to the previous year, driven by a combination of urbanization and a growing middle class.

Gold has also regained its allure among Indian investors, with many viewing it as a hedge against inflation and currency fluctuations. The recent spike in gold prices has prompted HNWIs to allocate a portion of their portfolios towards this precious metal, reflecting a broader trend of seeking safe-haven assets.

Venture Capital and Private Equity on the Rise

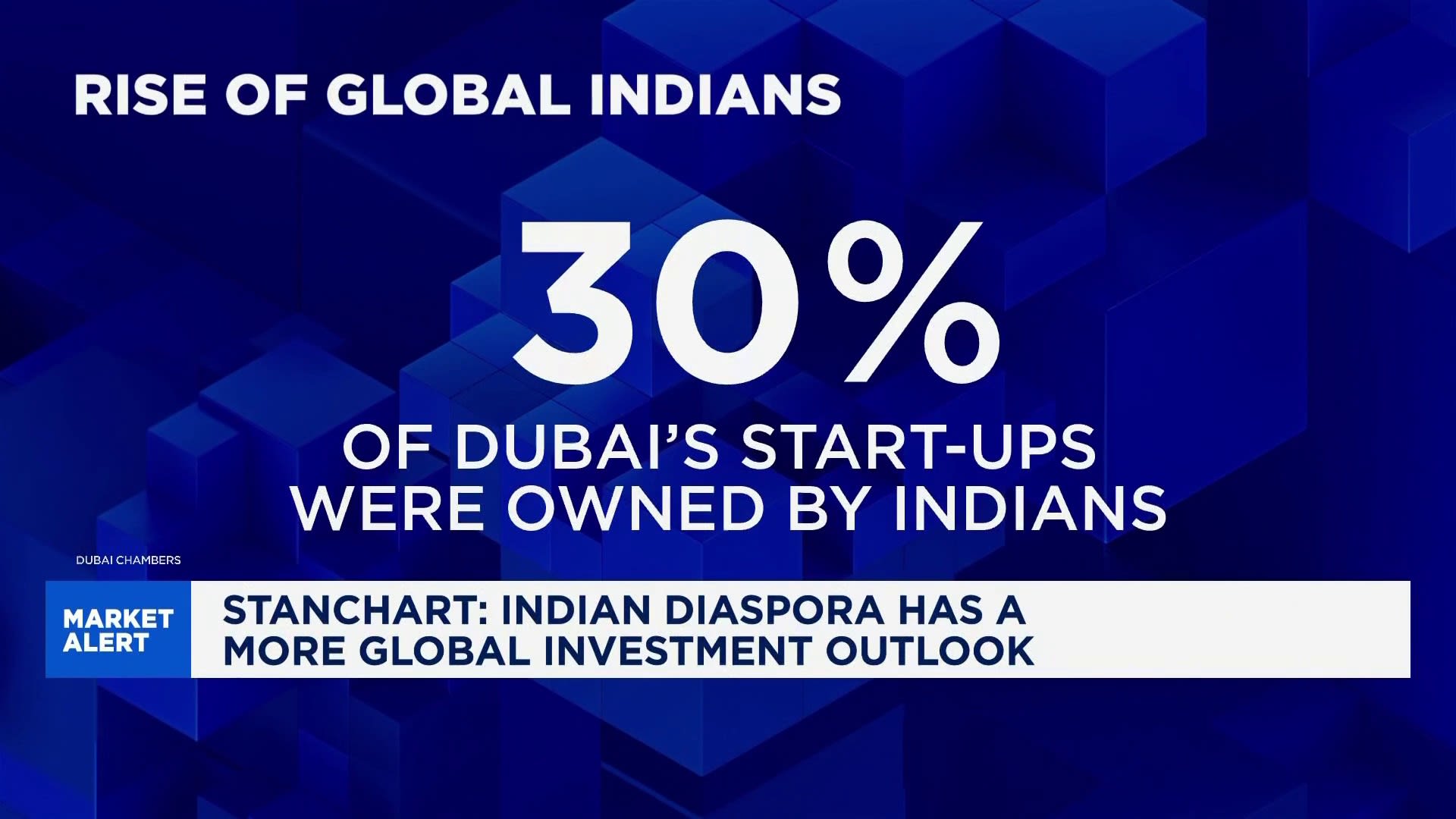

In addition to real estate and gold, investments in venture capital and private equity are becoming increasingly attractive. The Indian startup ecosystem has witnessed remarkable growth, prompting HNWIs to seek opportunities in innovative industries. According to industry reports, funding in Indian startups exceeded $10 billion in 2022, a clear indicator of the appetite for high-risk, high-reward investments.

As the investment landscape evolves, HNWIs are also focusing on sustainable and impact-driven ventures. There is a noticeable shift towards socially responsible investments that align with personal values and contribute positively to society. This trend is not only reshaping individual portfolios but also influencing broader market dynamics.

Overall, the investment strategies of India’s high net worth individuals are undergoing a transformation driven by economic shifts and changing consumer behaviors. With a diverse array of options now available, these investors are strategically positioning themselves to navigate the complexities of the modern financial landscape.