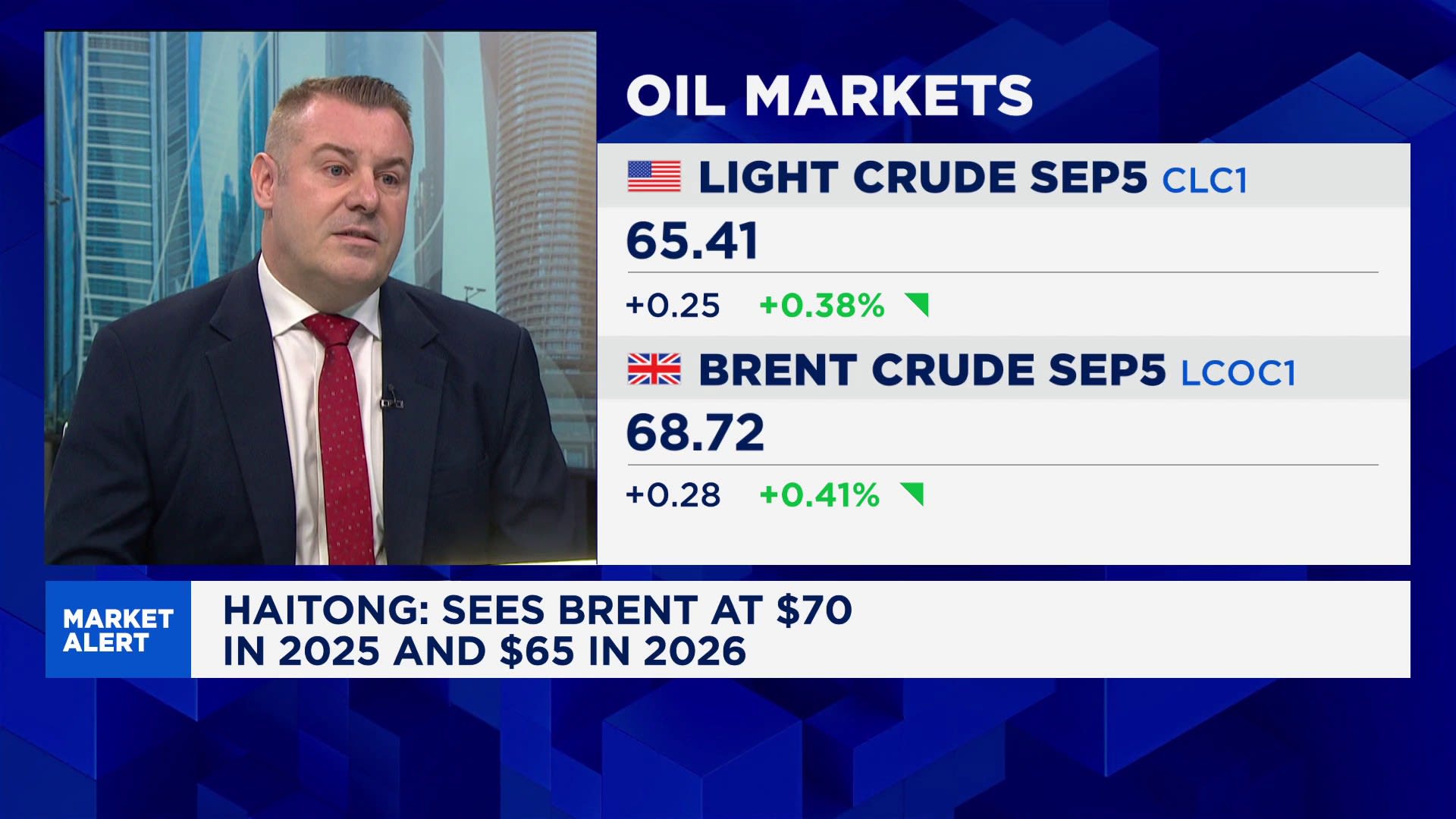

Oil prices are expected to decline as demand wanes, according to a report from **Haitong Securities**. The investment firm has noted that several factors are contributing to this anticipated decrease, with lower global consumption levels playing a significant role.

Analysts at Haitong suggest that oil demand is projected to fall by **2%** in the first quarter of **2024**, particularly due to reduced consumption in **Asia** and **Europe**. This forecast comes amid ongoing economic uncertainties and shifting energy policies in various countries.

Global Consumption Trends Impacting Prices

As the world’s economies navigate through fluctuating energy demands, the **Organization of the Petroleum Exporting Countries (OPEC)** is closely monitoring the situation. OPEC’s recent decisions regarding production cuts may not be sufficient to counterbalance the decline in demand. In fact, the cartel’s strategy appears increasingly challenged as countries focus on sustainable energy sources and reduce their reliance on fossil fuels.

The report highlights that significant reductions in industrial activity in **China** and changes in consumer behavior in the **United States** are contributing to the shift. Haitong’s analysts emphasize the importance of these trends in understanding the broader implications for oil prices.

Market Reactions and Future Outlook

In the wake of this report, market reactions have begun to reflect the anticipated changes. Oil prices have already seen a slight dip, with benchmarks falling below **$80 per barrel**. This decline is expected to influence not only the energy sector but also related industries, including transportation and manufacturing.

Investors are advised to remain vigilant as the situation evolves. Haitong’s insights suggest that if demand continues to decline, we may see prices drop further, potentially influencing global economic stability. The interplay between supply cuts from OPEC and decreasing demand will be crucial in shaping the market landscape in the coming months.

In summary, **Haitong Securities** forecasts a challenging environment for oil prices as lower demand drives a potential decline. Both consumers and investors should be prepared for ongoing volatility as the market adjusts to these new realities.