The Global X Cybersecurity ETF (NASDAQ:BUG) is facing a challenging year amid increasing scrutiny from investors, even as the demand for cybersecurity solutions continues to swell. This thematic exchange-traded fund, designed to capitalize on the rising threat of cybercrime, is currently navigating what analysts have termed a “Perfection Regime.” This shift in market expectations demands exceptional performance from high-growth technology companies, regardless of their underlying strengths.

Despite the pressures, the fundamentals of cybersecurity remain robust. The sector is witnessing a surge in threats, particularly from AI-enabled attacks which autonomously exploit system vulnerabilities on a larger scale. As businesses ramp up their security expenditures, the ETF’s concentrated holdings in leading cybersecurity firms—such as CrowdStrike, Palo Alto Networks, Fortinet, and Check Point Software—indicate a promising outlook.

Investor Sentiment and Market Expectations

The current market environment has led to a significant shift in how investors evaluate technology stocks. Companies like Zscaler, a top holding within BUG, have experienced this firsthand. Despite strong operational performance, Zscaler has faced intense scrutiny, reflecting a broader trend where even solid results are not sufficient if they do not meet elevated expectations.

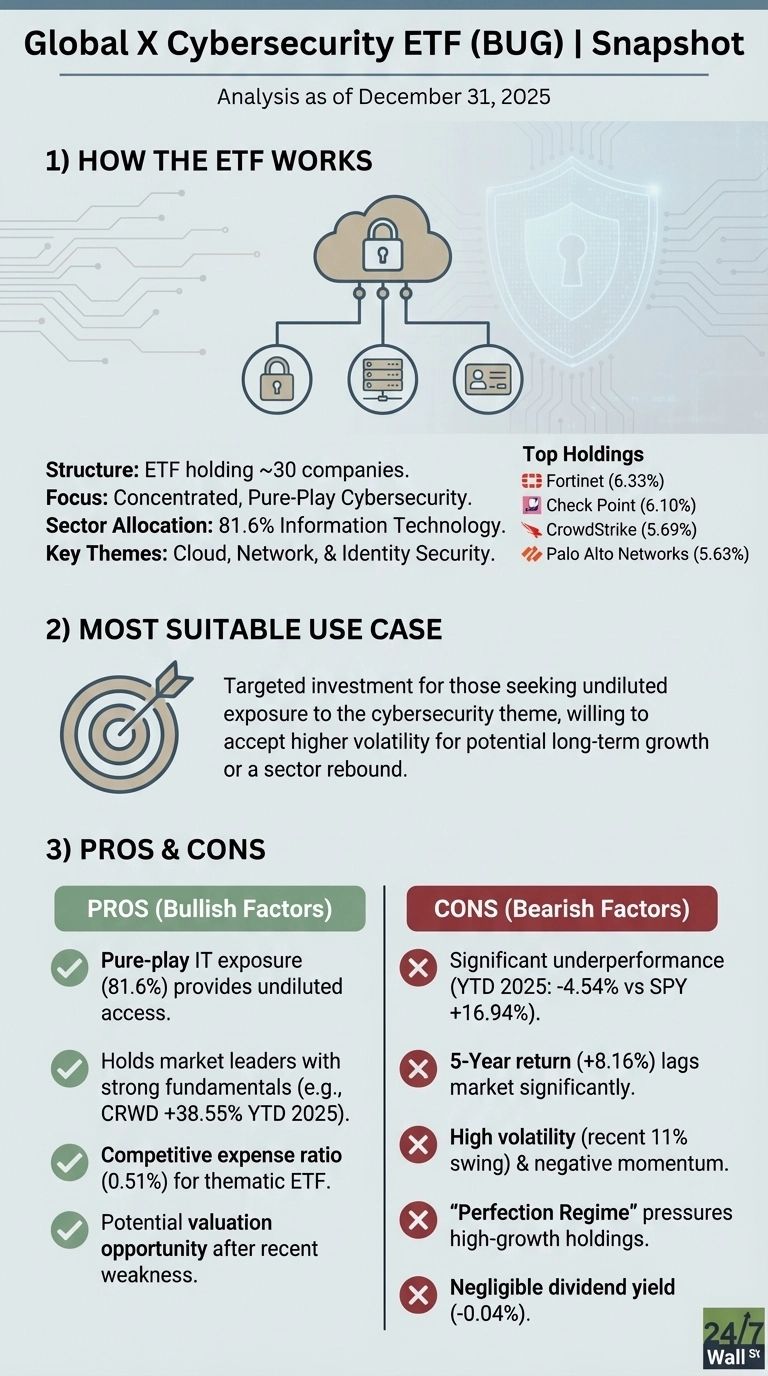

This change in investor sentiment can largely be attributed to the high valuation multiples assigned to these firms. The expectation of flawless execution and consistent growth has become paramount, resulting in market volatility for BUG and its constituents. The fund has concentrated its investments with approximately 81.6% allocated to the Information Technology sector, underscoring its commitment to cybersecurity.

The acceleration of enterprise security investments is a critical indicator of future performance. Notably, announcements regarding IT budgets and security spending commitments, usually revealed during earnings calls in January and February, will serve as key indicators. If Chief Financial Officers prioritize cybersecurity amidst rising threats, it could signal a strong momentum for the sector.

Looking Ahead to 2026

As the cybersecurity landscape evolves, two factors will be pivotal in determining the performance of the Global X Cybersecurity ETF in 2026. First, watch for the announcements related to enterprise IT budgets. Increased allocations for cybersecurity measures will be a clear signal of confidence in the sector’s future.

Second, investors should closely monitor the execution quality of the companies within the ETF. Given the current Perfection Regime, consistent delivery on key metrics such as billings, guidance, and customer growth is essential. Regularly reviewing quarterly earnings releases and investor presentations from these firms will provide valuable insights into their operational health.

For those seeking broader exposure with potentially less volatility, the First Trust NASDAQ Cybersecurity ETF (NASDAQ:CIBR) may be an alternative. CIBR, which has been operational since 2015, offers deeper liquidity and a more diversified portfolio, which could help mitigate risks associated with individual stock performance.

As cybercrime continues to escalate, the demand for cybersecurity investments is likely to grow. However, the success of these investments will hinge on the ability of cybersecurity firms to meet the high expectations set by the market. Investors should remain vigilant and informed as they navigate this complex landscape.