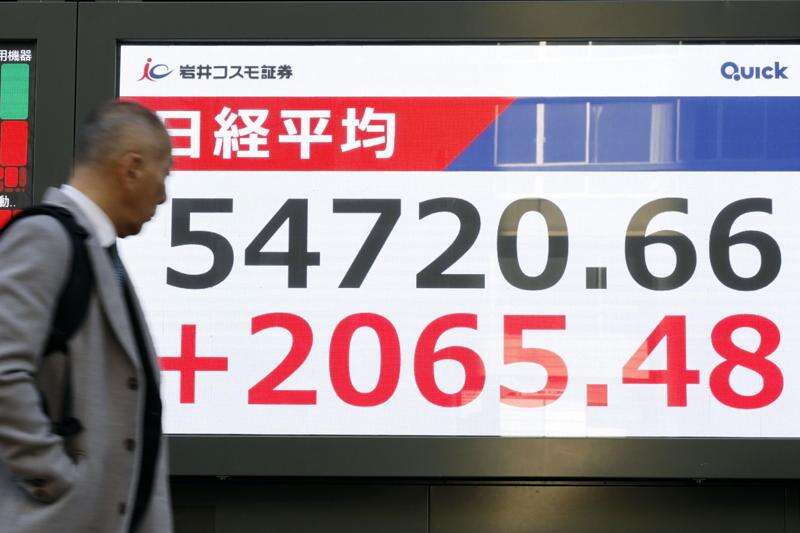

Global stock markets experienced a significant upswing on Tuesday, driven by remarkable gains in South Korea and Japan. The South Korean benchmark index surged by nearly 7%, while Japan’s Nikkei 225 soared by 3.9%, reaching an unprecedented closing level of 54,720.66. This rally reflects renewed investor confidence, particularly in technology-related shares.

In Europe, trading also showed positive momentum. France’s CAC 40 rose 0.6% to 8,232.71, while Germany’s DAX increased by 1.0%, reaching 25,053.90. The UK’s FTSE 100 recorded a modest rise of 0.2%, landing at 10,361.21. Futures for the S&P 500 were up 0.3%, and the Dow Jones Industrial Average experienced a 0.1% gain.

Investors are keenly awaiting upcoming earnings reports from major companies, which will provide insights into the effects of ongoing trends, including trade tariffs introduced by former U.S. President Donald Trump and potential restrictions on rare earth exports from China.

Japan’s Nikkei 225 increase was bolstered by significant rises in specific stocks. Shares of Disco Corp. jumped 7.4%, while Advantest, a testing equipment manufacturer, saw its stock rise by 7.1%. Analysts suggest that the anticipated electoral success of Prime Minister Sanae Takaichi‘s Liberal Democratic Party in the upcoming parliamentary elections on February 8 could lead to more market-friendly policies.

Despite the optimism, there are concerns regarding the potential weakening of the Japanese yen if Takaichi increases government spending, which could pose challenges for consumers and some businesses.

In South Korea, the Kospi index rose by 6.8% to reach 5,288.08, also a record high. Investors regained confidence following fears of a potential bubble in artificial intelligence, with stocks like Samsung Electronics Co. jumping 11.4% and SK Hynix climbing 9.3%.

Hong Kong’s Hang Seng index increased by 0.2% to 26,834.77, and the Shanghai Composite index added 1.3%, closing at 4,067.74. Meanwhile, Australia’s S&P/ASX 200 moved up by 0.9% to 8,857.10. The Reserve Bank of Australia raised its benchmark policy rate for the first time in two years, citing inflation concerns that exceeded prior expectations.

On Monday, the S&P 500 managed to gain 0.5%, breaking a three-day losing streak, while the Dow climbed 1.1% and the Nasdaq composite rose 0.6%.

In commodities, gold prices increased by 6.7% on Tuesday, and silver prices rebounded nearly 14%. The surge in precious metals is attributed to a flight to safety amid uncertainties regarding the Federal Reserve’s future direction, particularly following the nomination of Kevin Warsh as the next chair. The chair of the Federal Reserve significantly influences economic conditions and market stability through interest rate adjustments.

In early trading, benchmark U.S. crude oil prices dipped 4 cents to $62.10 per barrel, while Brent crude fell 13 cents to $66.17. The U.S. dollar weakened slightly against the yen, trading at 155.52 Japanese yen, down from 155.61 yen. The euro traded at $1.1819, up from $1.1791.

As global markets react to these shifts, investors remain vigilant, looking for signs of stability and growth amid a complex economic landscape.