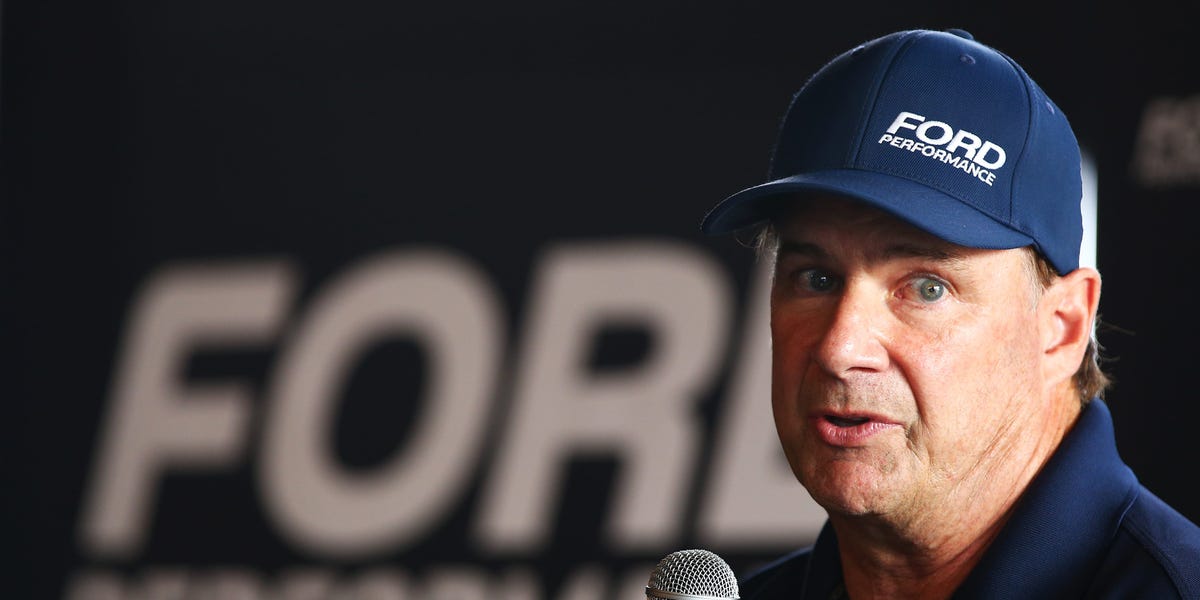

Jim Farley, the CEO of Ford, has issued a stark warning about the growing dominance of China’s electric vehicle (EV) industry, describing it as a significant threat to the future of the American automaker. Speaking at the Aspen Ideas Festival, Farley emphasized the urgency of the situation, stating, “We are in global competition with China and it’s not just EVs. And if we lose this, we do not have a future Ford.”

Farley’s remarks come amid increasing concerns over China’s rapid advancements in the EV sector. During a conversation with author Walter Isaacson, Farley revealed that he had visited China six to seven times in the past year to witness these developments firsthand. He described the experience as “the most humbling thing I have ever seen,” noting that 70% of all EVs in the world are made in China.

China’s Technological Edge

According to Farley, the technological capabilities of Chinese EVs are far superior to those found in Western vehicles. He highlighted the seamless integration of technology in Chinese cars, saying, “Huawei and Xiaomi are in every car. You get in, you don’t have to pair your phone. Automatically, your whole digital life is mirrored in the car.”

Farley attributed part of the challenge faced by Ford and other Western automakers to the reluctance of tech giants like Google and Apple to enter the car business. “Beyond that, their cost, their quality of their vehicles is far superior to what I see in the West,” he added.

Competition from Chinese Tech Giants

This isn’t the first time Farley has acknowledged the prowess of Chinese companies in the automotive industry. Last year, he praised Xiaomi, a major player in the tech world, calling it an “industry juggernaut and a consumer brand that is much stronger than car companies.” Farley even admitted to driving Xiaomi’s maiden electric vehicle, the Xiaomi Speed Ultra 7, for six months after having it flown from Shanghai to Chicago.

Xiaomi continues to make waves in the EV market, recently unveiling its second electric vehicle, the YU7. Marketed as a “luxury high-performance SUV,” the YU7 is positioned as a more affordable alternative to Tesla’s Model Y. Xiaomi reported receiving over 200,000 orders for the YU7, which is priced at $35,000 compared to the Model Y’s $36,760.

Ford’s Strategic Shift

Meanwhile, Ford is re-evaluating its own strategy in response to these developments. In August, Ford’s Chief Financial Officer, John Lawler, announced a shift in the company’s EV strategy, opting to replace planned electric SUVs with hybrid models. This strategic pivot is expected to cost Ford nearly $2 billion.

Despite these challenges, Ford’s stock has seen a positive trajectory, with shares up by over 9% year to date. However, the company did not respond to a request for comment on Farley’s recent statements.

Implications for the Global Auto Industry

The rise of China’s EV industry presents significant implications for the global automotive market. As Chinese companies continue to innovate and expand their reach, traditional automakers like Ford face mounting pressure to adapt and compete. The situation underscores the importance of technological advancement and strategic partnerships in maintaining a competitive edge.

Experts suggest that Western automakers may need to collaborate more closely with tech companies to enhance their in-vehicle technology offerings. Additionally, investments in research and development could play a crucial role in bridging the gap between Western and Chinese EV capabilities.

As the global race for EV supremacy intensifies, the actions taken by companies like Ford will be closely watched. The outcome of this competition could reshape the automotive landscape for years to come, determining which players will lead the charge in the next era of transportation.