When Ford Motor Company unveiled its **Universal EV Platform** on **August 15, 2025**, CEO **Jim Farley** framed the initiative as a pivotal moment for the automaker, likening it to the launch of the Model T. This ambitious strategy aims to produce affordable electric vehicles (EVs) at scale while relying on domestically sourced lithium iron phosphate (LFP) batteries and simplified manufacturing processes. With a commitment of **$5 billion** already in place, Farley acknowledged the risks associated with the plan, emphasizing that while he could not promise success, it was a necessary gamble for Ford to maintain its competitive edge.

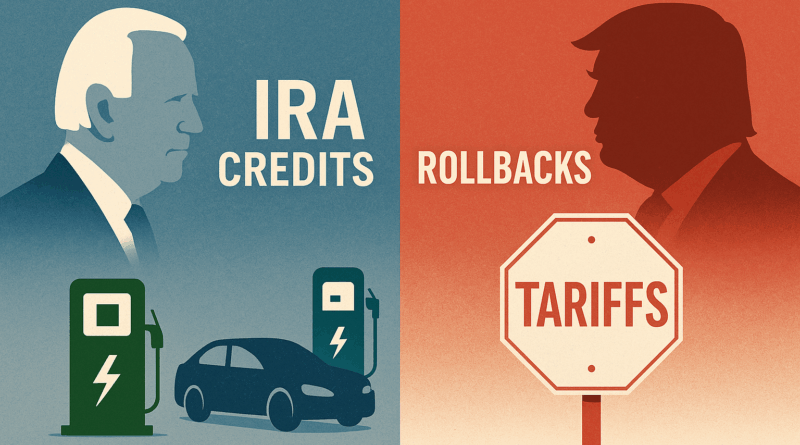

This initiative comes at a time when U.S. policy regarding electric vehicles is undergoing significant changes. The Trump administration has reversed many incentives previously established under the **Inflation Reduction Act**, notably eliminating the **$7,500** consumer tax credit for qualifying EVs and rolling back funding for charging infrastructure. Additionally, the administration has imposed **50% tariffs** on imported steel and aluminum, including from Canada and Mexico. These developments present challenges for Ford’s strategy, which hinges on reducing consumer prices and production costs.

The groundwork for the Universal EV Platform was laid between **2022** and **2024**, during which Ford established a skunkworks operation in California, operating outside its traditional development framework. This period saw a supportive political climate, with policies encouraging EV adoption. The rationale was clear: invest in advanced design and manufacturing to reduce costs, localize critical supply chains, and prepare for mass-market EVs with competitive total ownership costs.

The guiding policy during this phase was straightforward—prioritize cost reduction and domestic production. This approach recognized that the primary barrier to EV adoption was affordability rather than engineering challenges. The Universal EV Platform incorporates innovative features such as **20% fewer parts**, **25% fewer fasteners**, and a modular assembly process designed to cut production time by up to **40%**. Furthermore, the new zonal electrical architecture aims to simplify wiring and electronics, enhancing the overall efficiency of vehicle assembly.

As of **August 2025**, the shift in U.S. policy presents a complex challenge for Ford. The removal of financial incentives has increased the effective price of EVs and hampered the expansion of public charging networks, which are vital for consumer confidence. If these policy changes persist, they could undermine Ford’s economic assumptions that justified the substantial investments made in previous years.

Ford’s current strategy seems to rely on the expectation that pro-EV incentives will return under a future administration. By continuing to invest in tooling, battery plants, and supplier commitments, Ford may be banking on a political shift that could realign the market in favor of EV adoption before the Universal EV Platform reaches peak production.

Some elements of the platform do offer promise, particularly in the commercial vehicle sector. Fleet operators, including utilities and delivery services, may find the platform’s attributes appealing. The simplified manufacturing processes and the ability to configure vehicles into various body styles could cater to segments where daily charging at depots is feasible, making the relatively short range of the base **51 kWh** battery less of a limitation.

Despite these advantages, the Universal EV Platform faces stiff competition in the U.S. market. Rivals such as **Tesla**, **General Motors**, and **Toyota** are also positioning new models to capture the affordable EV segment. With new offerings from these manufacturers emphasizing longer ranges and competitive pricing, Ford’s strategy must not only execute effectively but also adapt to the evolving landscape of consumer preferences.

In summary, while Ford’s Universal EV Platform represents a bold step toward affordable electrification, the shifting policy environment poses significant risks. The alignment of diagnosis, guiding policy, and coherent actions that characterized the initial investment phase has been disrupted. As the company moves forward, it must navigate these challenges while executing its vision effectively to remain relevant in a fast-changing market.