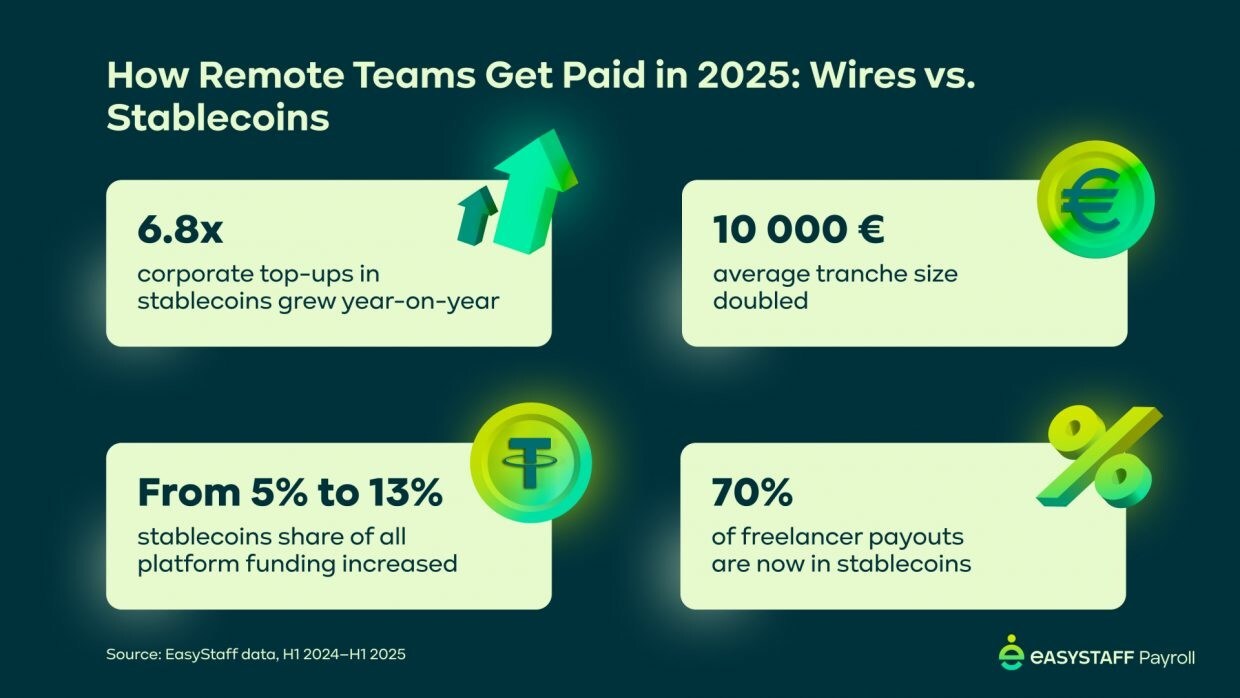

EasyStaff, a global B2B payments platform, has reported a remarkable increase in the use of stablecoins for corporate payroll, with adoption rising by a staggering 6.8 times year-over-year. This data, revealed on October 1, 2025, showcases a significant shift in corporate treasury management as businesses increasingly pivot from traditional banking systems to digital assets for international transactions.

The data, based on internal transaction metrics from the first half of 2025, indicates that the average corporate stablecoin deposit has more than doubled, increasing by 134% from €4,700 to €10,000. This trend suggests a strategic move by finance leaders to consolidate payments, reduce transaction fees, and enhance operational efficiency. Moreover, the total volume of stablecoin transactions nearly tripled during this period.

Key Insights on Corporate Payment Trends

This report, which marks one of the first comprehensive analyses of corporate stablecoin use, highlights several critical findings. Corporate stablecoin deposits have surged from 5% to 13% of all B2B transactions on EasyStaff’s platform. This explosive growth underscores the increasing confidence businesses have in using cryptocurrencies for payroll.

In addition, the data reveals a strong preference for stablecoins among freelancers, with crypto withdrawals maintaining a robust rate of nearly 70%. This trend positions stablecoins as the default payout method within the contractor economy. Furthermore, a notable 71% increase in hiring has been observed between companies based in the U.S. and UAE and talent from Eastern Europe and Central Asia, indicating a broader shift in global workforce dynamics.

While previous studies, including those from FXC Intelligence and McKinsey, have recognized the mainstream adoption of stablecoins, EasyStaff’s data stands out as it provides specific growth metrics from a functioning payments platform in this evolving landscape.

The Future of Global Payroll Management

The growing adoption of stablecoins is reshaping the future of global payroll management. As companies increasingly adopt a “multi-rail” treasury strategy, they are blending the security of traditional wire transfers with the speed and efficiency that stablecoins offer. This combination is no longer a theoretical concept but a practical necessity for organizations competing for talent on a global scale.

In summary, EasyStaff’s findings not only reflect a significant shift in how companies approach payroll but also signal a broader transformation in the financial landscape. As more businesses embrace digital assets, the implications for corporate finance and workforce management could be profound.

About EasyStaff: Founded in 2018, EasyStaff is a global service platform that connects businesses with freelancers and international talent under seamless B2B contracts. Operating in over 120 countries, EasyStaff serves more than 2,100 companies and facilitates payments for over 30,000 freelancers.