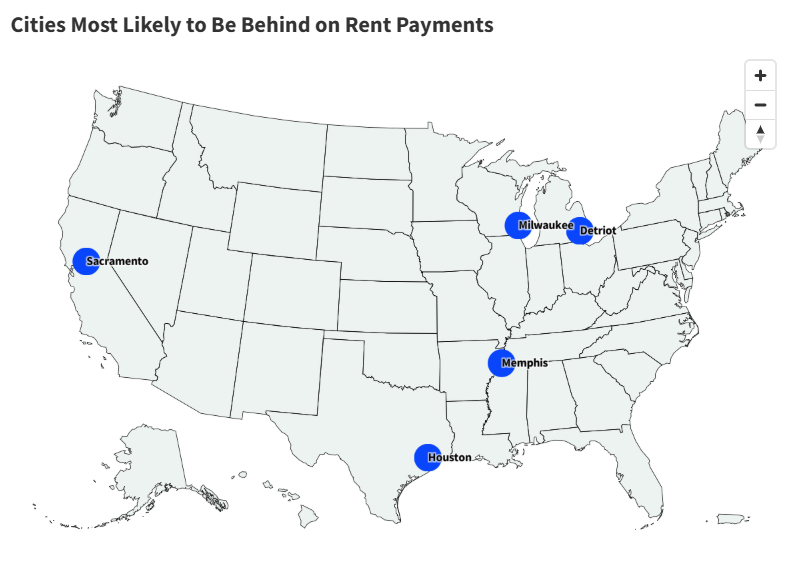

URGENT UPDATE: A shocking new report reveals that rent payments are spiraling out of control in several U.S. cities, with nearly 50% of tenants falling behind. According to data from landlord banking platform Baselane, cities like Milwaukee and Sacramento are leading the nation in late rent payments, highlighting the urgent crisis many Americans are facing as housing costs continue to soar.

The average rent in the U.S. has reached $2,088, causing significant financial strain for millions. Despite a slight decrease of $12 in the past month, inflation remains a critical concern, with the consumer price index increasing by 2.9% in August from the previous year. Many tenants are struggling to keep up with these rising costs, particularly in cities with stagnant wages.

In a detailed analysis of nearly 100,000 rent payments, Baselane found that late payments are particularly prevalent in the following cities: Milwaukee at 68%, Sacramento at 59%, Houston at 58%, and Detroit at 54%. In Memphis, tenants are only managing to pay on time 50% of the time.

Michael Ryan, a finance expert and founder of MichaelRyanMoney.com, emphasized that these tenants are not “deadbeat” individuals but rather victims of circumstance. “Car breaks down? Rent’s late. Kid gets sick? Rent’s late,” he explained. “Most eventually pay up; they just can’t hit the 1st of the month consistently.”

In contrast, cities such as San Francisco and Long Beach are faring better, with on-time payment rates reaching 85%, while Seattle and Tucson follow closely at 84%. However, the consequences of late payments can be severe, leading to additional fees and long-term damage to credit scores.

The report underscores a troubling trend: economic uncertainty is affecting both low-income families and those in the middle class. “We’re seeing high economic uncertainty on both sides of the income spectrum,” noted Alex Beene, a financial literacy instructor at the University of Tennessee at Martin. This widespread issue not only impacts individual families but poses risks to the broader economy as well.

Mathias Korder Fort, CEO of Baselane, pointed out the significance of on-time payments in the landlord-tenant relationship. “This data illustrates just how much payment behavior can vary from city to city,” he stated, emphasizing the need for landlords to understand these trends.

Kevin Thompson, CEO of 9i Capital Group, warned that simply increasing wages may not resolve the rent crisis. “As wages increase, prices in the area would likely follow suit, making everything more expensive for everyday life,” he said. This feedback loop could exacerbate the existing challenges faced by tenants across the nation.

As the situation develops, it’s clear that both renters and landlords must navigate a precarious landscape. With rent prices climbing and economic pressures mounting, the urgent need for solutions has never been more pressing.

Stay tuned as we continue to monitor this evolving situation, which is affecting countless lives and reshaping urban economies across the United States.