UPDATE: A new report reveals that Chinese nationals are leading a significant resurgence in the U.S. housing market, investing an astonishing $13.7 billion from April 2024 to March 2025. This marks a dramatic increase from just $7.5 billion the previous year, highlighting a renewed interest in American real estate amid ongoing struggles in China’s own housing sector.

According to the latest data from the National Association of Realtors (NAR), foreign buyers collectively spent $56 billion on U.S. homes during this period, with Chinese buyers accounting for a striking 24.5 percent of that total. Their investment represents a remarkable 83 percent year-over-year increase, signaling a potential shift in global real estate dynamics.

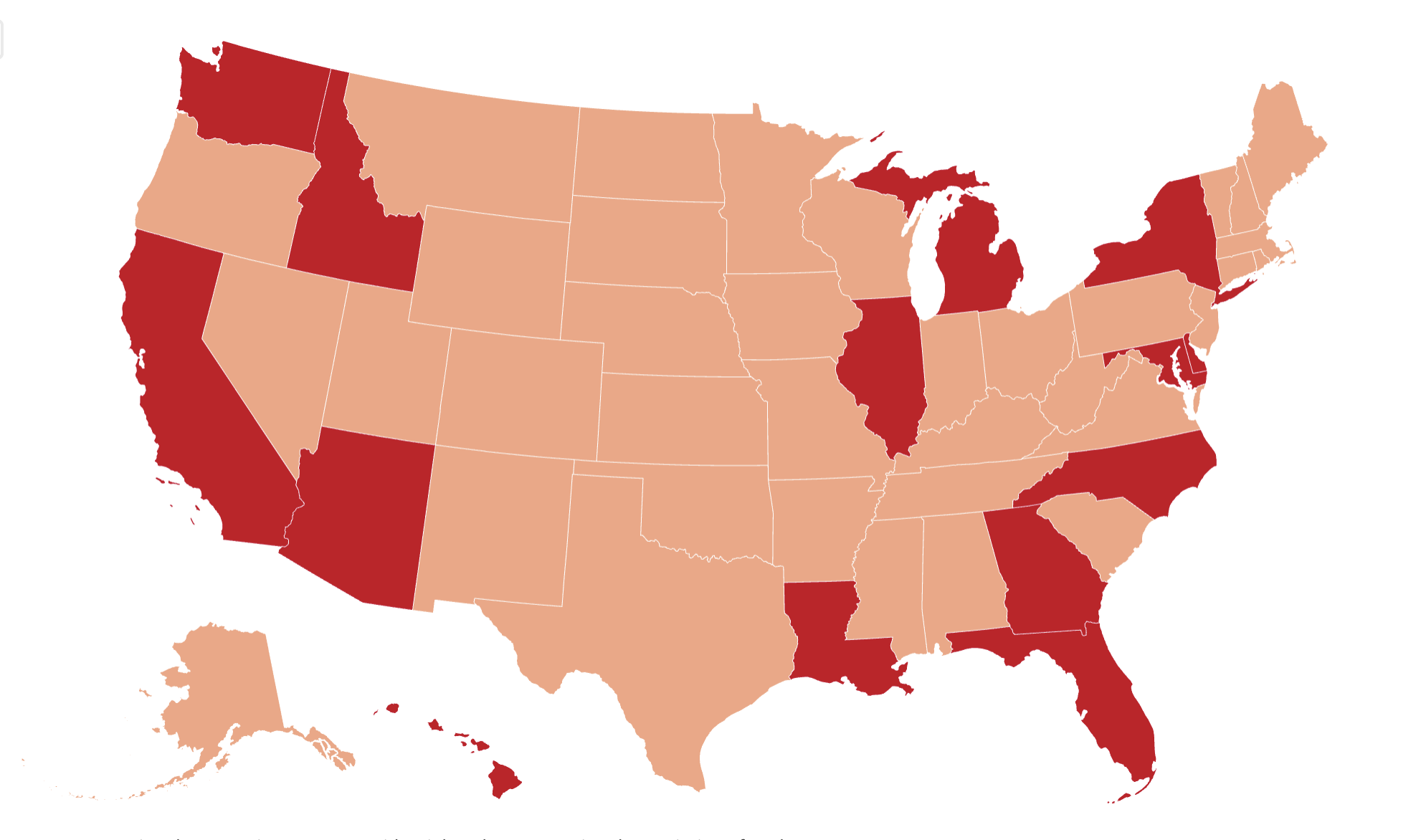

California emerges as the top destination for Chinese buyers, capturing a notable 36 percent of their purchases. Following closely are Maryland and New York, each attracting 9 percent of these buyers. The appeal of California lies in its proximity to China, robust economic opportunities, and strong cultural ties, making it an attractive investment location.

In a statement to Newsweek, Matt Christopherson, Director of Business and Consumer Research at NAR, emphasized, “The Chinese housing market has been slow to recover following the pandemic, so Chinese buyers see a beneficial opportunity in diversifying their investment portfolios with exposure to stronger U.S. markets.”

The report comes at a critical time as tensions escalate between Washington and Beijing over trade policies, raising questions about the future of foreign investments in U.S. real estate. While the impact of the budding trade war remains uncertain, the current surge in Chinese purchases reflects a strategic move to capitalize on favorable U.S. market conditions.

Additionally, the data indicates that 11,700 homes were purchased by Chinese buyers out of a total of 78,100 homes bought by foreigners in the U.S. This demographic represented 15 percent of all foreign buyers, indicating a strong presence in the market.

Interestingly, Maryland’s popularity among Chinese buyers is notable, especially as it typically attracts fewer purchases from other foreign nationalities. The NAR report suggests that many of these buyers are seeking residential properties in the D.C. area, with 57 percent identified as resident buyers, looking for detached single-family homes either for personal use or as rental investments.

The map released by NAR visually highlights the top destinations for Chinese homebuyers, underscoring the significant interest in U.S. real estate. With ongoing economic challenges in China, the trend may continue to rise, making the U.S. housing market an increasingly attractive option for international investors.

As this situation develops, industry experts will be closely monitoring how geopolitical factors influence foreign buyer activities in the U.S. housing market. The implications of these investments are profound, potentially impacting housing prices and availability in key markets across the country.

Stay tuned as we bring you the latest updates on this evolving story and its potential ramifications for the U.S. real estate landscape.