Economic data from China is expected to make headlines on July 15, 2025, as analysts anticipate that the country’s second-quarter gross domestic product (GDP) surpassed the government’s annual target. The upcoming release of economic activity data for June will provide further insights, with projections suggesting a stable performance in industrial production (IP) and investment, while retail sales may experience a slight decline.

Analysts predict that China’s economy likely grew at a rate exceeding the government’s target for the year, reflecting ongoing resilience. The expected GDP growth comes at a time when China’s leadership is focused on countering deflationary pressures. President Xi Jinping has intensified his “anti-involution” policy, aiming to stimulate economic activity and bolster consumer confidence.

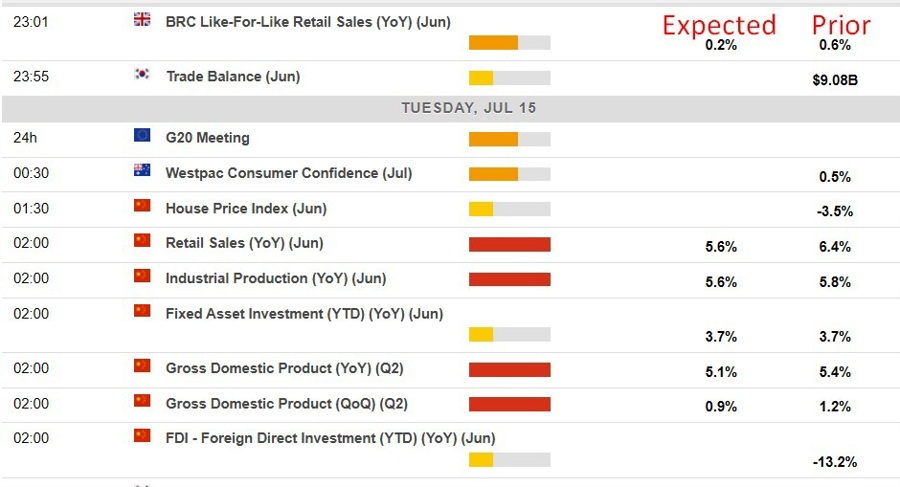

As for June’s economic indicators, expectations vary. While industrial production and investment are projected to remain steady, retail sales are anticipated to dip to a healthy 5.6% year-on-year growth rate. This figure, although lower than previous months, underscores a continuing positive trend in consumer spending.

Investor sentiment remains cautiously optimistic. Equities in China are receiving support from substantial inflows, as both sovereign wealth funds and central banks adjust their strategies. The question of where these funds are being redirected is gaining attention, particularly as global investors assess the potential for growth in the Chinese market.

In light of these developments, forecasts suggest that China will ramp up its fiscal support in the latter half of 2025. This move is aimed at sustaining economic momentum and addressing any lingering deflationary challenges. According to the ForexLive economic data calendar, the release of these figures will be closely monitored by market participants.

The times listed in the economic calendar are in GMT, and the prior results will also be provided for context. These indicators will play a critical role in shaping investor perceptions and expectations moving forward. As China continues to navigate its economic landscape, the focus remains on how effectively it can balance growth with inflationary pressures.