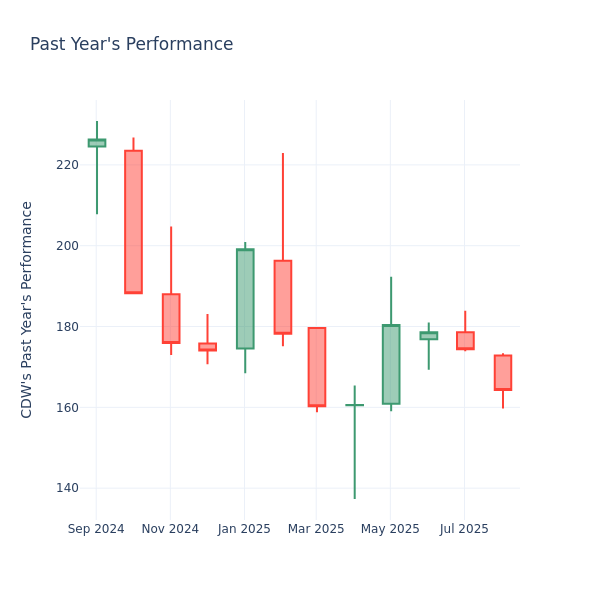

CDW Inc. experienced a notable increase in its stock price during the current market session, rising by 2.59% to reach $164.29. Despite this uptick, the company’s shares have dropped by 6.53% over the past month and by a significant 24.18% over the past year. This trend raises questions among shareholders regarding the stock’s valuation relative to its performance.

Understanding the price-to-earnings (P/E) ratio is crucial for assessing whether CDW’s stock may be undervalued. The P/E ratio compares the company’s current share price to its earnings per share (EPS), providing insight into investor expectations regarding future growth. A higher P/E ratio typically indicates that investors anticipate better performance, suggesting that a stock may be overvalued. Conversely, a lower P/E could imply that investors expect subdued growth.

CDW’s P/E Ratio Compared to Industry Standards

CDW Inc. currently holds a P/E ratio of 19.92, which is notably lower than the industry average of 36.6 within the Electronic Equipment, Instruments & Components sector. This disparity may signal to investors that CDW’s stock could underperform compared to its peers. Nevertheless, it also opens the possibility that the stock is undervalued, presenting a potential buying opportunity.

While the P/E ratio serves as a valuable tool for evaluating a company’s market performance, it is essential to recognize its limitations. A lower P/E ratio does not solely indicate undervaluation; it may also reflect a lack of confidence among shareholders regarding the company’s growth prospects. Additionally, this metric should not be analyzed in isolation. Other factors, such as industry trends and overall economic conditions, can significantly influence a company’s stock price.

Investors are encouraged to consider the P/E ratio alongside other financial indicators and qualitative assessments. This comprehensive approach can help in making informed investment decisions that align with individual risk tolerance and market conditions.

In summary, while CDW Inc. has shown some resilience in its stock price recently, the broader context of its performance and the P/E ratio compared to industry standards will play a critical role in shaping investor outlooks in the coming quarters.