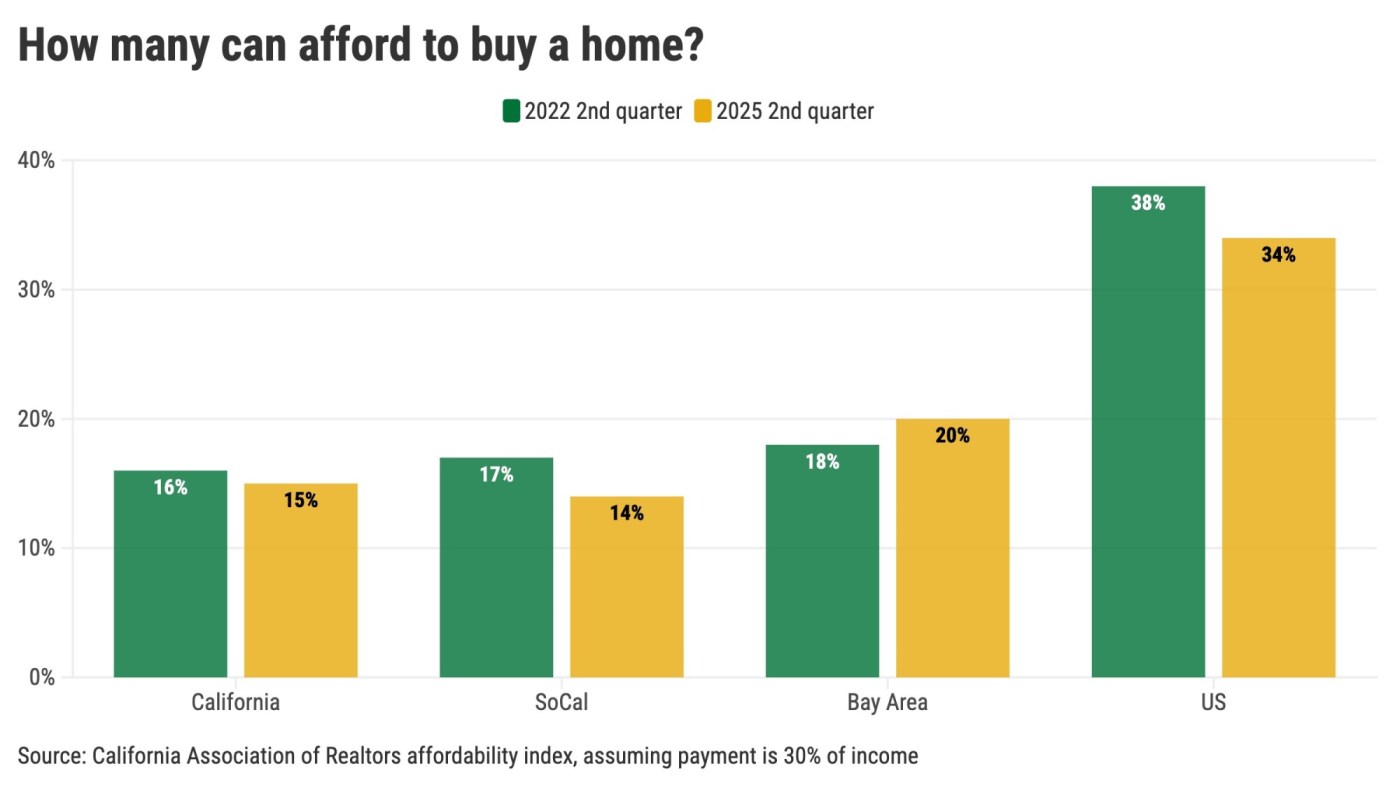

UPDATE: New data reveals that only 15% of Californians can afford to purchase a home, starkly contrasting with 34% of Americans nationwide. This alarming statistic was confirmed in the latest affordability report from the California Association of Realtors, highlighting a growing crisis in the state.

In 2025, the median home price in California surged to $905,680, requiring a staggering annual income of $232,400 to qualify for a mortgage. This is an increase of $33,200 or 17% since 2022. Comparatively, the national median home price stands at $429,400, necessitating a household income of $110,400, which has also risen by $17,200 or 18% in the same timeframe.

The implications of these figures are profound. With only 15% of households able to afford homes in California, the housing market remains exceedingly competitive and inaccessible for many families. Just 14% of Southern California households can afford to buy, down from 17% in 2022. In contrast, the Bay Area, despite a 6% decrease in home prices, sees 20% of its households managing to purchase a home, which is an improvement from 18% previously.

The affordability crisis is exacerbated by rising interest rates. As of now, the average mortgage interest rate has climbed to 6.9%, up from 5.4% three years earlier. This increase, coupled with property taxes and insurance costs, has left many potential buyers struggling. The calculations suggest a prospective homeowner in California requires an astonishing $181,000 for a down payment, compared to $86,000 nationally.

The Federal Reserve’s shift away from its low-interest policies has played a significant role in this housing dilemma. By ceasing the purchase of mortgage bonds, the Fed has contributed to the current high-interest environment, which further complicates home-buying prospects.

In California, affordability is not uniform. The Bay Area’s median home price of $1.4 million demands an income of $359,200 this spring, reflecting an increase of $22,000 or 7% over the last three years. Buyers also face a daunting down payment requirement of $280,000. Meanwhile, in Southern California, where the median home price is $850,000, households need to earn $218,400, a rise of $38,000 or 21% since 2022.

As the housing affordability crisis continues to unfold, many families are feeling the pressure. The dream of homeownership is slipping away for a significant number of Californians, with the burden falling disproportionately on lower and middle-income households.

Next steps: Homebuyers and advocates are urged to keep an eye on policy changes and economic developments that could impact the housing market. As this situation evolves, officials and experts will be closely monitoring how these trends affect housing availability and affordability across the state.

This urgent housing crisis in California is a call to action for policymakers, real estate professionals, and community advocates. The need for creative solutions and immediate interventions has never been more critical. As the landscape shifts, families across the state anxiously await relief from this growing affordability crisis.