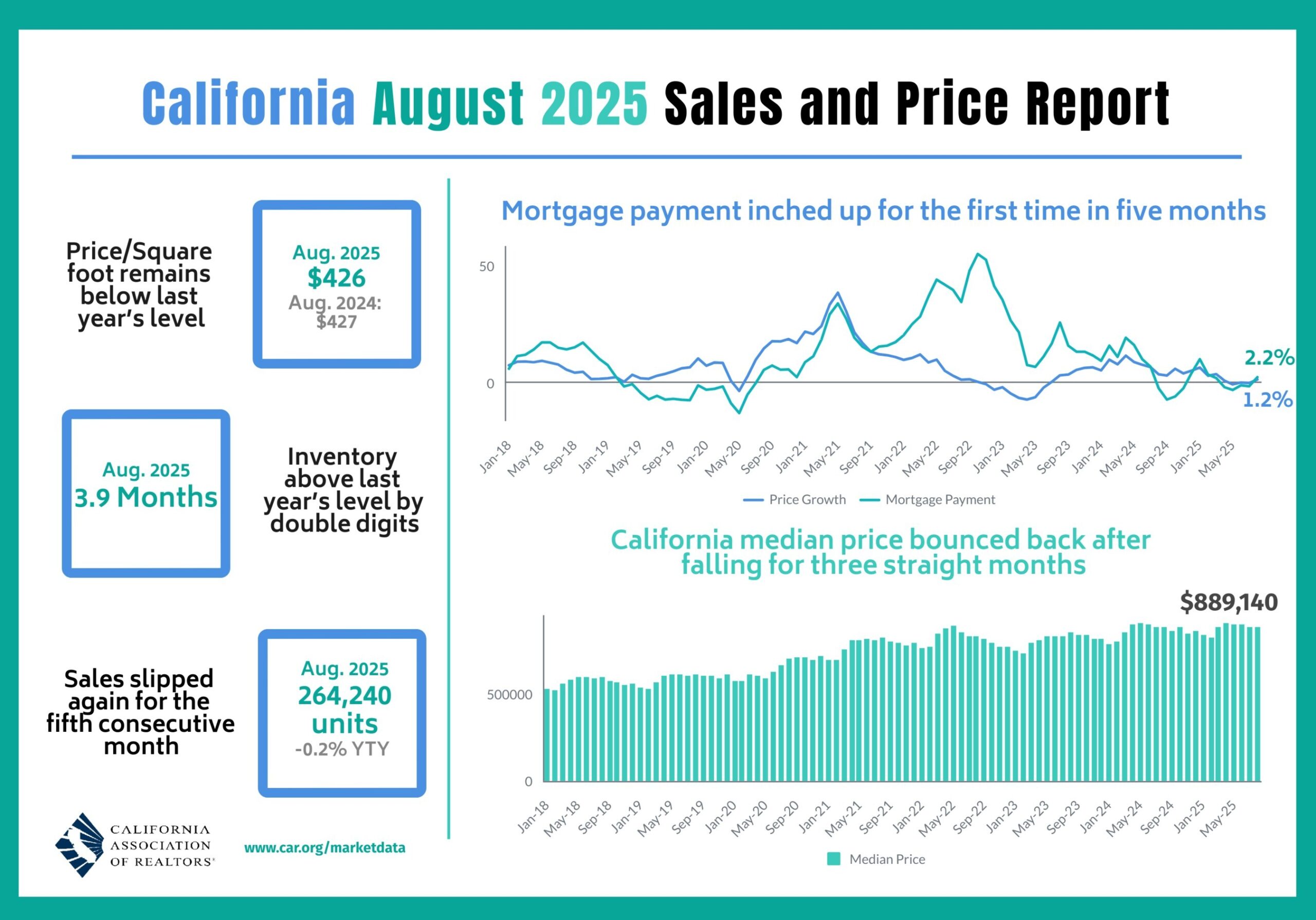

Home sales in California experienced a notable rebound in August 2025, driven by a decline in mortgage rates and stabilizing home prices. According to the California Association of Realtors (C.A.R.), existing single-family home sales reached a seasonally adjusted annualized rate of 264,240—a 0.9 percent increase from July’s 261,820 but a slight decrease of 0.2 percent compared to August 2024.

The statewide median home price rose to $899,140 in August, reflecting a 1.7 percent increase from $884,050 in July and a 1.2 percent rise from $888,740 in August 2024. This marks the end of three consecutive months of annual price declines. Despite these improvements, year-to-date home sales remain down by 0.4 percent compared to the previous year.

Market Trends and Economic Indicators

C.A.R. reports that statewide pending sales surged by 8.3 percent from July, coinciding with mortgage rates hitting a ten-month low. On a year-over-year basis, pending sales rose by 0.2 percent, marking the first increase in nine months. This improvement comes amid indications of economic weakness, suggesting that a more favorable borrowing environment may be encouraging potential buyers.

C.A.R. President Heather Ozur expressed optimism, stating, “Despite a softer-than-expected home buying season this year, a bounce back in pending sales last month is an encouraging sign that sales could improve for the rest of the year.” She noted that many prospective homebuyers have delayed purchases, waiting for more favorable mortgage rates.

The upward trend in home prices is also significant. The median home price’s increase outpaced the typical average growth of 1.2 percent observed from July to August. Jordan Levine, C.A.R.’s Senior Vice President and Chief Economist, highlighted that while sales demand had previously softened, the stabilization in home prices and a decrease in reduced-price listings indicate a potential balance between supply and demand in the market.

Regional Variations and Inventory Trends

Regionally, sales trends varied significantly across California. Only two major regions recorded year-over-year sales gains: the Far North, which saw a 2.9 percent increase, and the Central Coast, with a 1.6 percent rise. In contrast, the San Francisco Bay Area experienced the most significant decline, with sales dropping by 4.1 percent, followed by Southern California and the Central Valley with decreases of 3.7 percent and 3.5 percent, respectively.

At the county level, 24 out of the 53 counties tracked by C.A.R. reported year-over-year sales gains in August. Notably, Mariposa County led with an impressive 81.8 percent increase, followed by Lassen County at 46.7 percent and Kings County at 36.1 percent. Conversely, some counties faced substantial declines, including Yuba County, which saw a decrease of 35.3 percent.

The Unsold Inventory Index (UII) rose to 3.9 months in August, indicating that while housing demand remains soft, there is a slight uptick in supply. Total active listings increased by 23.5 percent compared to the previous year, although the pace of growth is slowing, suggesting a potential cooling in the market as the year progresses.

In terms of market dynamics, the median number of days required to sell a single-family home increased to 31 days, up from 22 days in August 2024. The statewide sales-price-to-list-price ratio was recorded at 98.3 percent, down from 100 percent a year earlier.

The average interest rate for a 30-year fixed mortgage was 6.59 percent in August, a slight increase from 6.50 percent in August 2024. These trends indicate a complex interplay of supply, demand, and financing costs that will likely shape the California housing market in the coming months.

As the market adapts to these changes, analysts and real estate professionals will be watching closely to determine if the current trends can be sustained and how they will impact future home sales throughout California.