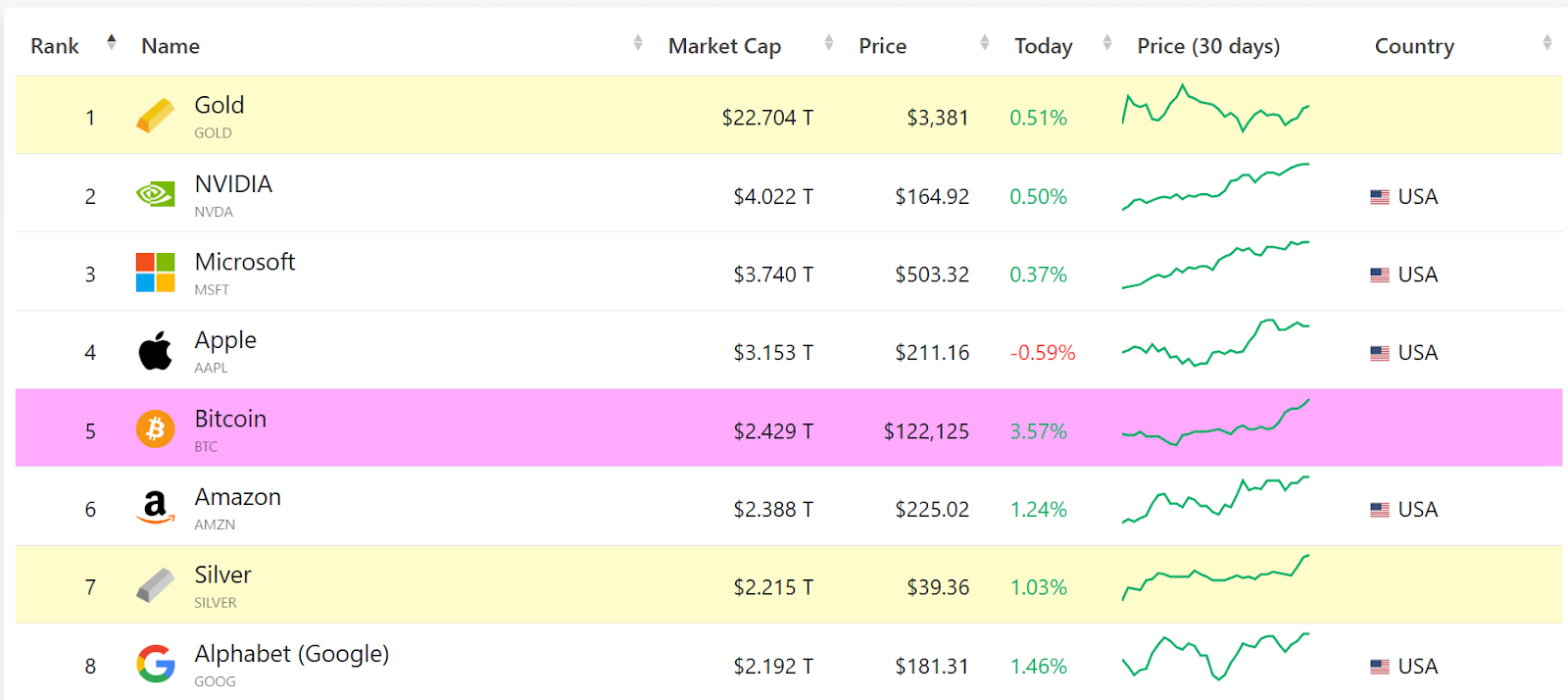

Bitcoin has achieved a significant milestone, overtaking Amazon in market capitalization to become the world’s fifth-largest asset. On Monday, Bitcoin’s price soared to an all-time high of $122,600, marking a nearly 13% increase over the past week, according to data from Cointelegraph. This surge allowed Bitcoin’s market capitalization to exceed $2.4 trillion, surpassing Amazon’s $2.3 trillion, Silver’s $2.2 trillion, and Alphabet’s $2.19 trillion. At the time of this report, Bitcoin’s market cap was just $730 million shy of tech giant Apple.

Institutional Adoption Fuels Bitcoin’s Rise

The recent price surge can be attributed to growing institutional interest in cryptocurrency. Since June 5, the number of companies holding Bitcoin on their balance sheets has more than doubled. Currently, over 265 companies are reported to hold Bitcoin, up from 124 just weeks ago. Collectively, these companies hold approximately 3.5 million Bitcoin in their treasuries. Within this total, around 853,000 BTC, or 4% of the total supply, is held by public companies, while spot Bitcoin exchange-traded funds (ETFs) account for over 1.4 million BTC, or 6.6% of the supply.

The surge in institutional investment is underscored by recent activity in the Bitcoin ETF market. Spot Bitcoin ETFs experienced a remarkable seven-day buying streak, adding significant liquidity that has supported Bitcoin’s price momentum. On Friday, these ETFs saw net inflows exceeding $1 billion, as reported by Farside Investors. The influx of capital from Bitcoin ETFs has been a crucial catalyst in pushing Bitcoin’s price to new highs.

Regulatory Developments Increase Market Interest

Bitcoin’s recent price rally is also influenced by heightened regulatory interest in the cryptocurrency sector. Dubbed “Crypto Week” by the U.S. government, lawmakers are pursuing three key cryptocurrency bills aimed at fostering the national crypto industry. These proposals include the Guiding and Establishing National Innovation for US Stablecoins (GENIUS Act), the Digital Asset Market Clarity Act (CLARITY Act), and the Anti-CBDC Surveillance State Act, which seeks to prevent the implementation of a central bank digital currency (CBDC).

The potential passage of these bills is expected to further legitimize the cryptocurrency market and attract additional investors. In February 2024, these ETFs accounted for 75% of new investments into Bitcoin over a two-week period, contributing significantly to the asset’s rise above $50,000.

Bitcoin’s ascent is not just a financial phenomenon; it reflects a broader shift in how corporations and institutional investors view cryptocurrency as a viable investment. As Bitcoin continues to gain traction and its market cap expands, its role in the financial landscape is likely to evolve, drawing further interest from both individual and institutional investors.