URGENT UPDATE: The U.S. housing market is facing a critical moment as reports confirm that government bailouts are imminent to prevent a crash. With home affordability at an all-time low, officials are preparing to intervene, ensuring that home prices do not plummet amid rising financial pressures.

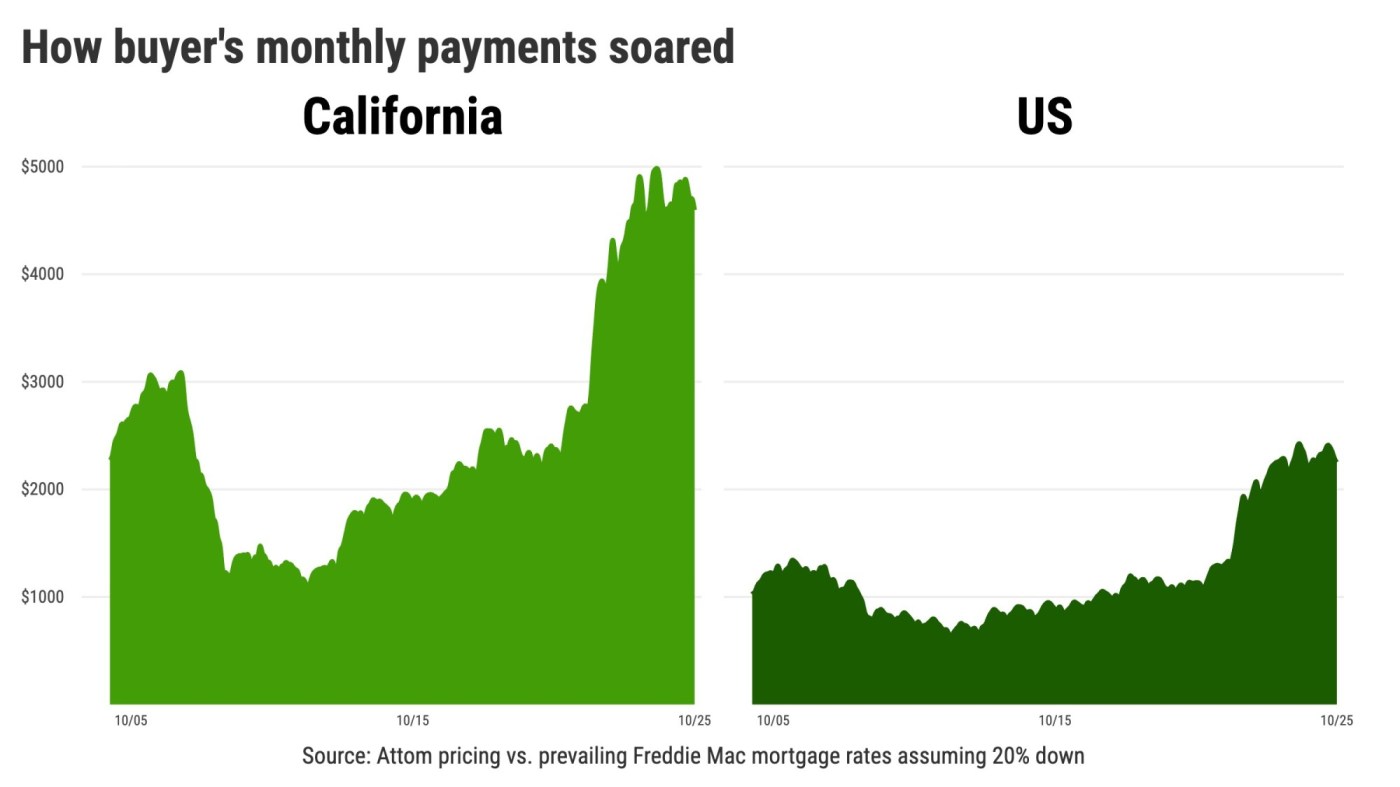

As of October 2023, the national monthly payment for a median-priced home reached $2,251, reflecting a 99% increase over the past five years. In California, homeowners are grappling with an even steeper burden, with payments averaging $4,597 for a median home price of $735,000. These figures highlight a staggering 154% rise in payments over the last decade and raise questions about the sustainability of housing affordability.

To combat the risk of a market collapse, the federal government is expected to introduce a series of measures aimed at stabilizing the housing market. One proposal includes the introduction of a 50-year mortgage, designed to ease financial pressure on homebuyers. Additionally, two federal mortgage agencies are reportedly working to lower mortgage rates by holding certain home loans, which will shift rate risks from private investors to the government.

These interventions could provide a temporary boost to the housing market, but they come at a cost. Critics warn that increased government aid may distort an already fragile market. Following previous interventions, home sales plummeted by 26% nationally when mortgage rates began to rise from historic lows. California saw an even sharper decline, with sales dropping 31%.

Analysts suggest that while these bailouts may create short-term relief for buyers and homeowners, they ultimately mask deeper issues within the housing market. The reliance on government solutions could deter necessary adjustments, such as allowing home prices to fall to more manageable levels.

Furthermore, these bailouts may widen the gap between those who can afford to buy homes and those who cannot. Financial incentives for first-time buyers and potential tax breaks for homeowners could create fierce competition among buyers, leaving many potential homeowners out in the cold.

WHAT’S NEXT: As the government prepares to roll out these measures, industry experts will be closely monitoring their impact. Homebuyers are urged to stay informed as the market evolves and to consider how these changes may affect their purchasing power.

In conclusion, the housing market stands at a crossroads. With escalating payments and looming government intervention, the question remains: will these bailouts truly stabilize the market, or merely prolong its inevitable correction? As developments unfold, the urgency for potential homeowners to act has never been greater.