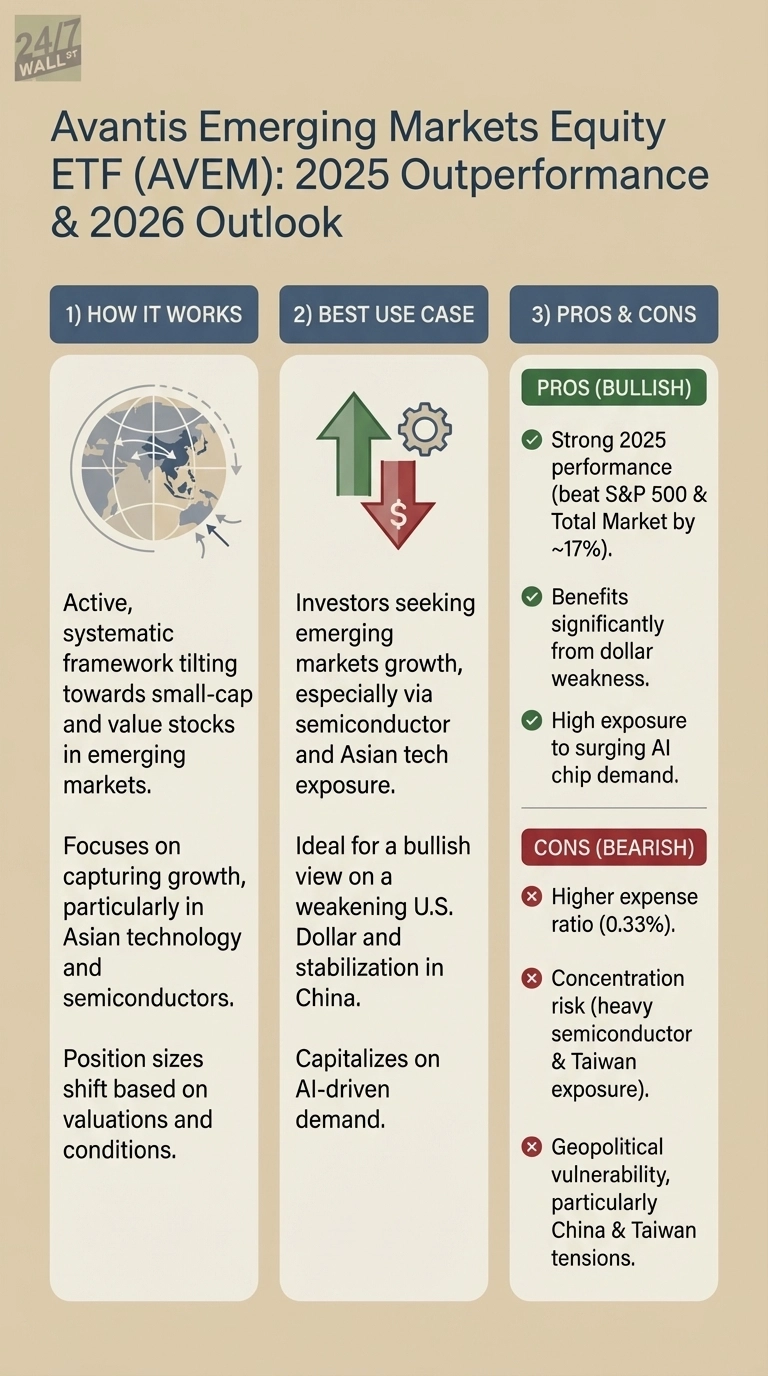

The Avantis Emerging Markets Equity ETF (NYSEARCA:AVEM) achieved a remarkable return of 35% in 2025, significantly outperforming Vanguard’s largest funds by approximately 17 percentage points. With assets totaling $15.1 billion, the fund’s strong performance indicates a potential resurgence for emerging markets, particularly as it holds a substantial stake in Asian technology and financial sectors.

AVEM’s success is attributed in part to a 9% decline in the value of the US dollar throughout 2025, which made emerging market assets more appealing to investors. This dollar weakness resulted in improved returns for those investing in markets outside the United States. The Avantis fund notably outperformed both the Vanguard S&P 500 ETF (NYSEARCA:VOO) and the Vanguard Total Stock Market ETF (NYSEARCA:VTI), signaling a shift in investor interest toward emerging markets.

Key Factors Influencing Future Performance

As the market looks ahead to 2026, the strength of the dollar will be a crucial macroeconomic factor to monitor. Continued dollar weakness could provide significant tailwinds for AVEM, encouraging capital inflows into developing economies and enhancing local currency returns for US investors. Observing the dollar index will be essential; if it breaks above recent highs, AVEM could see reduced momentum regardless of the fundamental performance of its holdings.

Another significant variable impacting AVEM is the economic trajectory of China. The fund has considerable exposure to major Chinese companies such as Tencent and Alibaba, along with investments in Chinese banks. Recent policy shifts by the Chinese government aimed at bolstering the private sector have positively influenced AVEM’s performance. Should this supportive environment continue into 2026, the fund may continue to thrive. Conversely, any tightening of policies or rising geopolitical tensions could pose challenges.

Sector Concentration and Risks

A notable aspect of AVEM’s portfolio is its substantial investment in the semiconductor industry, particularly its largest holding, Taiwan Semiconductor Manufacturing Company (NYSE:TSM), which constitutes 6.35% of the fund. Alongside other semiconductor giants like Samsung Electronics and SK Hynix, this concentration has driven impressive returns, particularly as demand for AI chips surged in 2025. However, this focus also introduces vulnerability. A downturn in the semiconductor cycle or disruptions in the supply chain could have immediate repercussions for AVEM.

Geopolitical risks are another factor to consider, especially given Taiwan’s significant role in the fund’s holdings. Tensions between Taiwan and China could add an unpredictable element to AVEM’s performance. While the expansion of TSM in Arizona may mitigate some risks, the overall geopolitical exposure remains substantial.

Investors looking for a simpler and potentially more cost-effective way to gain exposure to emerging markets might consider the iShares Core MSCI Emerging Markets ETF (NYSEARCA:IEMG). With assets totaling $117 billion compared to AVEM’s $15.1 billion, IEMG offers greater liquidity and a lower expense ratio of 0.09%, significantly undercutting AVEM’s 0.33% fee.

While AVEM has focused on smaller companies and undervalued stocks, IEMG follows a broader market-cap weighted index. The effectiveness of AVEM’s strategy in 2025 raises questions about whether such an approach will continue to yield positive results in the future, especially in light of potential shifts in market dynamics.

As 2026 approaches, investors will need to consider whether the current trends in dollar weakness and semiconductor demand will persist, or if AVEM’s positioning will result in increased volatility. The interplay of these elements will largely determine the fund’s trajectory in the coming year.