On February 5, 2024, Alabama lawmakers introduced a trio of bills aimed at regulating tax incentives for data centers and addressing concerns about the impact of these facilities on utility costs for everyday consumers. The proposed legislation seeks to establish a framework that ensures large data centers do not shift excessive electricity costs onto residential and small business customers.

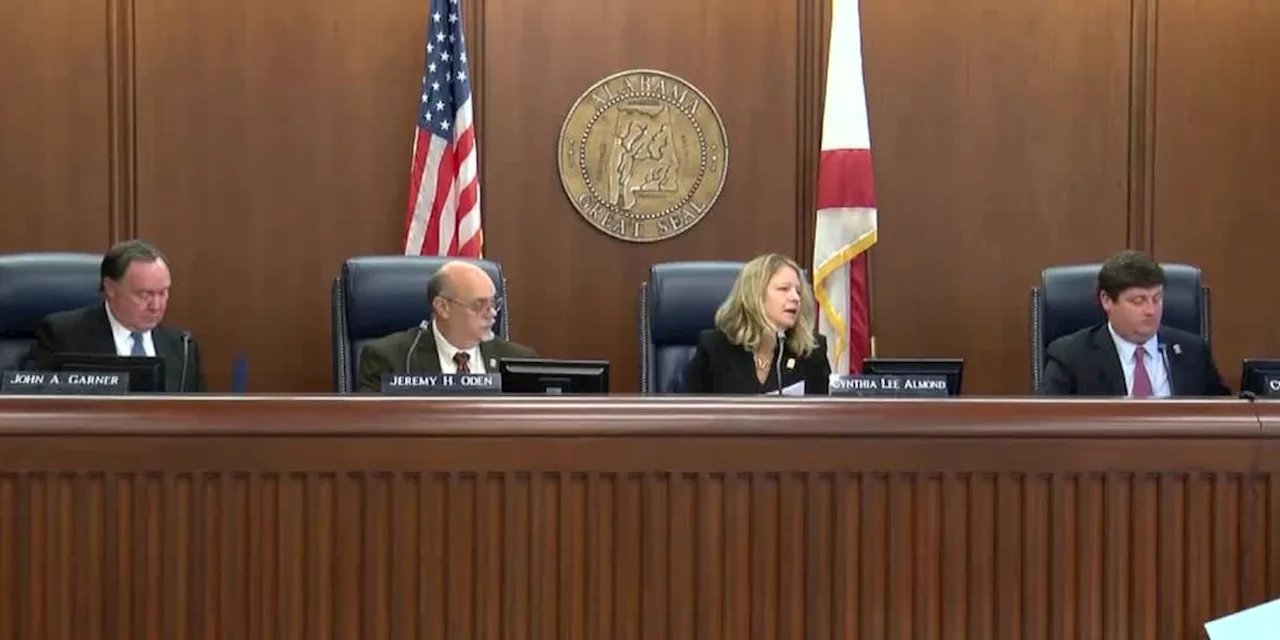

The three bills, currently under review by the Senate Committee on Fiscal Responsibility and Economic Development, focus on modifying how the state manages utility regulations and tax incentives. Senate Bill 270, sponsored by Senator Bell, specifically targets data centers that consume at least 150 megawatts of electricity—equivalent to the energy needs of approximately 112,000 homes. Under this bill, utilities would be required to ensure that these large consumers bear the costs they impose on the system, rather than passing them on to other customers.

Senate Bill 268 proposes significant changes to the governance of the Public Service Commission. If passed, the bill would eliminate elections for commission seats, allowing political leaders to appoint commissioners. Starting in 2028, the governor would appoint the commission president, with supplementary appointments made by the House Speaker and Senate President Pro Tempore, subject to Senate confirmation. This bill also aims to increase transparency and limit conflicts of interest by broadening restrictions on lobbying expenses, ensuring that utilities cannot transfer these costs to customers. Daniel Tait, Executive Director of Energy Alabama, criticized this move, stating, “If the Alabama Power Grab passes, the public loses oversight and the utility gains insulation once and for all.”

The third piece of legislation, Senate Bill 265, seeks to revise tax incentives currently available to data centers. Under existing regulations, the largest data centers can enjoy tax breaks lasting up to 30 years. The proposed bill would cap these incentives at 20 years for agreements made after January 1, 2027. Additionally, large data centers consuming over 100 megawatts would be required to pay state sales taxes on their purchases, although the governor could exempt those in economically disadvantaged counties. The new sales tax revenue would contribute to the state’s general fund rather than educational funding, extending the expiration of existing tax breaks from 2028 to 2032.

Alabama has recently attracted significant data center projects, capitalizing on low electricity costs and favorable tax incentives. However, the massive energy consumption of these facilities has raised concerns among residents and consumer advocacy groups about whether they are inadvertently subsidizing the operational costs of large tech companies.

As these bills move through the legislative process, they reflect a growing awareness and response to the economic implications of data centers on the state’s energy landscape. If enacted, the legislation would take effect in various stages starting in 2026, potentially reshaping the relationship between large data consumers and utility providers in Alabama.